The world’s two largest economies are set to release their latest inflation data respectively.

The US consumer price index (CPI) is forecasted to tick back up higher, while China is expected to reveal an outright deflation, with both the consumer and producer prices in negative territory together.

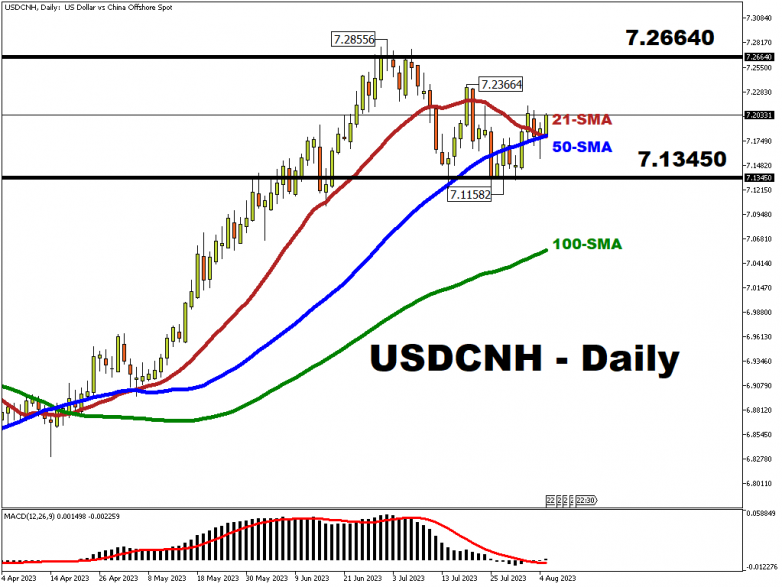

The Bloomberg FX model predicts that 7.13450 – 7.26640 is the likelier trading range for the Chinese Renminbi against the US Dollar this week.

Still, USDCNH appears guided upwards by its 50-day SMA over the past two weeks, even as China’s central bank has supported the Yuan since end-June.

Events Watchlist

- Tuesday, August 8th: China July external trade, US Treasury auctions

China's exports and imports are expected to post year-on-year contractions respectively (exports: -12.6%; imports: -5.5%). Slowing domestic and global demand may hamper China’s recovery, which could weigh on CNH. More US Treasuries issuances on the day may also lead to greater volatility on the USD side of this FX pair.

- Wednesday, August 9th: China’s July consumer price index (CPI)

China's consumer price index (CPI) is forecasted to come in at minus 0.5%, while producer prices are expected to have fallen by 4%. If so, this would be the first time since November 2020 that both are in negative territory. A shallower-than-expected drop would point to not-as-bad demand in the world’s second largest economy and potentially support the Chinese Renminbi.

- Thursday, August 10th: US July consumer price index (CPI)

Economists are forecasting a 3.3% year-on-year growth for the US CPI in July, edging higher from June’s 3% number. However, markets may pay greater attention to the month-on-month print for headline CPI, as well as core CPI, which are expected to match June’s numbers. Lower-than-expected CPI prints may allow the Fed to not hike anymore for the rest of 2023, which could drag USDCNH lower and offer some relief for the Yuan.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, August 7

- JPY: Bank of Japan’s July meeting minutes

- EUR: Germany June industrial production

- GBP: Speech by Bank of England Chief Economist Huw Pill

- USD: Speeches by Atlanta Fed President Raphael Bostic, Fed Governor Michelle Bowman

Tuesday, August 8

- AUD: Australia July business confidence; August consumer confidence

- CNH: China July external trade

- EUR: Germany July CPI (final)

- USD: US Treasury auctions of notes and bonds (until August 10th); speech by Philadelphia Fed President Patrick Harker

Wednesday, August 9

- CNH: China July CPI and PPI

- Walt Disney quarterly earnings

Thursday, August 10

-

USD: US July CPI; weekly initial jobless claims

Friday, August 11

- GBP: UK 2Q GDP, June industrial production

- USD: US August consumer sentiment; July PPI