Oil prices surged after Saudi Arabia announced that it will slash its output levels by 1,000,000 barrels per day (bpd) over February and March!

The shock decision was in stark contrast to market expectations leading up to this past Monday’s OPEC meeting, with the alliance of major Oil producing nations due to decide whether or not to hike output levels by 500,000 bpd again in February.

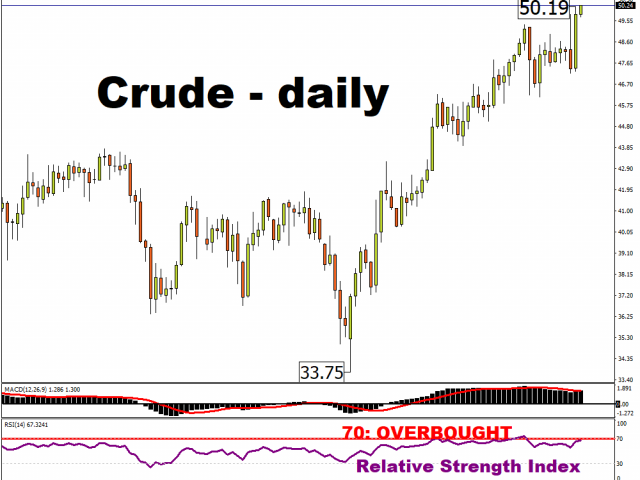

The shock announcement saw Crude oil prices breaching the psychologically-important $50/bbl mark for the first time since February. However, with its relative strength index now flirting with overbought levels, perhaps an immediate-term pullback is on the cards.

Likewise, Brent Oil, which is the global benchmark, reached its highest levels since February on the news. At the time of writing, it's on the cusp of reclaiming the $54/bbl handle.

Here’s a recap of OPEC output decisions since the global pandemic:

-

April 2020: will slash output by a record 9.7 million bpd beginning May 2020, or equivalent to around 10% of global supply, to offset the demand destruction wrecked by the pandemic.

-

July 2020: to restore some 2 million bpd starting August 2020 amid green shoots of the global economic recovery.

-

December 2020: to raise output by 500,00 bpd in January 2021, as opposed to the previously intended 2 million bpd, given the resurgence of Covid-19 cases and tighter virus-curbing measures in major economies.

- 4 January 2021: OPEC meeting adjourned as members were unable to reach consensus on February output levels - whether to rollover January’s output settings or raise them by another 500,00 bpd, as favoured by Russia.

Cracks within OPEC may resurface

Although Saudi Arabia’s decision has been cheered by Oil benchmark prices, it risks laying bare the power struggles within the alliance.

Saudi Arabia’s unilateral supply cuts clearly showcases Riyadh’s preference for higher Oil prices, although other producers prioritize retaining market share.

In recent weeks, Russia had been pushing for an output hike of 500,000 bpd, for fear that non-OPEC producers such as US shale oil producers may otherwise step in and fill the gap in the global markets. Under this latest arrangement, Russia can merely raise its production by a measly 65,000 bpd for each of the next two months. In recent past, the likes of Nigeria, Iraq, and the UAE have had their respective requests for output hikes denied.

Risk of moral hazard

If Saudi Arabia is apparently willing to do the heavy lifting for the other OPEC members, then the will to comply with existing output ratios may be diminished. In other words, other OPEC members who had been vying to preserve their market share may be emboldened to do so, knowing that Saudi Arabia would be there to step in to shore up prices with its own supply cuts.

The competing goals (higher prices vs. market share) may lay bare the fragility within the OPEC alliance, and one merely has to revisit the Oil price capitulation that was seen in March 2020 to realize what a divided OPEC alliance could do to Oil prices.

In order for Oil prices to continue its return to pre-pandemic levels, not only must the global economic recovery stay the course, OPEC members must also demonstrate a unified will and maintain the discipline to manage output levels.

Otherwise, the Oil price recovery could turn out to be a fleeting phenomenon.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.