Asian markets were choppy on Tuesday morning while European stocks struggled for direction after Wall Street fell overnight for the first time in five sessions.

The recent string of negative developments revolving around US President Donald Trump has fostered a sense of caution and unease. Given how the risk pendulum is poised to swing back and forth as investors juggle with various themes, the next few days could be interesting for markets. On one side of the scale, surging coronavirus cases, and renewed lockdowns across the globe have raised fears over the global economic recovery. However, the prospects of more stimulus and vaccine rollouts have provided a light at the end of the tunnel while raising hopes of some normality returning in the future.

While equity bulls are likely to derive strength from the ‘reflation trade’, obstacles in the form of rising yields and surging global coronavirus cases may limit upside gains.

Trump impeachment vote –

Things are set to heat up in Washington after Democrats introduced a resolution to impeach U.S President Donald Trump for a second time, setting the stage for a vote on Wednesday. The idea of Democrats pushing for the removal of Trump who has less than two weeks left in his term is likely to fuel risk aversion and spur demand for safe-haven assets. If this becomes reality, the move would mark a first in history as no president has ever been impeached twice.

What does this mean for the Dollar?

The burst of uncertainty from such a development could fuel appetite for the Dollar which remains a hotspot for safety. The Dollar Index is already experiencing a technical rebound with prices trading around 90.50 as of writing. A solid daily close above this point could encourage bulls to target 92.00 and 92.70, respectively.

Commodity spotlight – Oil

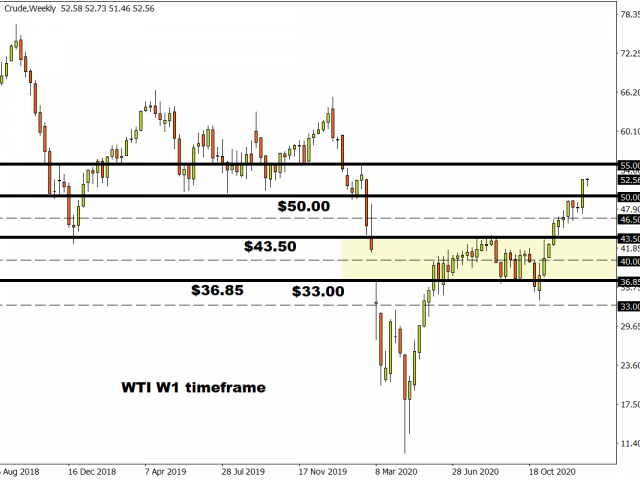

Oil prices are trading near levels not seen since February 2020 amid signs of tightening global supply. Although bulls remain in the driving seat, demand-side factors could spoil the party. Surging global coronavirus cases and associated lockdowns across the globe may fuel fears around weak oil demand. Volatility may be on the horizon for Oil which is up almost 7% since the start of 2021.

How the commodity performs this week may be influenced by the pending OPEC monthly market report and the Dollar’s movements.

Looking at the technical levels, WTI Crude may challenge $55 in the near term due to the bullish momentum.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.