The Dollar is endeavouring to cling on to its recent gains today as the DXY trades around the 20-day SMA and above the 90 mark. Bulls probably need to get back above the December high around 91.23 to stand any chance of arresting the long-term decline. This would then put us back in the range which held from August through to December last year. It is certainly worth noting that on a long-term chart, prices have been held up by the lows from the start of January 2018 which acted a very good support, before a strong bounce back.

Expectations of US growth outperformance versus the Eurozone may put the bearish USD story on the backburner. But as long as the Fed sticks to its new inflation framework, allows for CPI to overshoot and keeps rates on hold for an extended period out until the end of next year, then deeply negative real rates will weigh on the greenback.

With that in mind, today’s headline US CPI print came in a tick higher than expected at 1.4% with wage numbers fractionally higher. What’s coming is probably more important as high headline prints are expected for the March-June period when base effects kick in. By that, we mean the change in the monthly figure will be abnormally high form the year-ago month, and will no doubt get fingers pointing at the Fed and their reaction.

Otherwise, stocks are pretty quiet as we slip back into near-term angst over longer-term light (at the end of the ever longer tunnel) mode. Increasing infections of the new Covid strain are leading to extended lockdowns in European countries with Germany warning of another eight to 10 more weeks of strict measures. Meanwhile, vaccine rollout positivity, especially in the UK has helped give a bid to GBP which is the top performing major currency. Of course, the Governor of the Bank of England turning his nose up to NIRP yesterday is also helping. (Watch the 1.37 zone on the weekly GBPUSD chart – an upside breakout could see 1.40 quickly!)

Oil flying

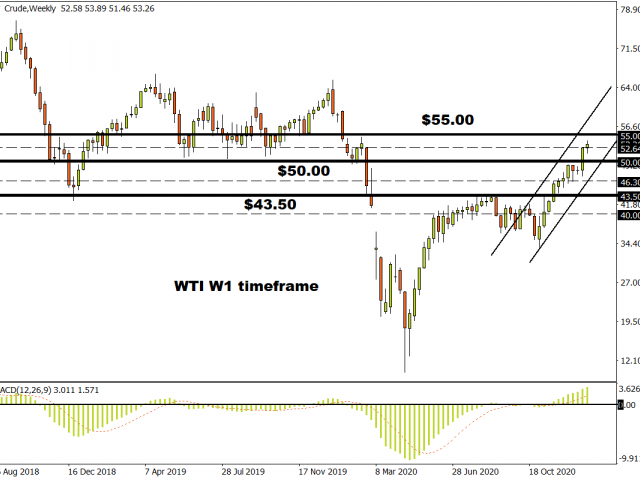

One asset not holding back is oil with crude prices rallying over 50% since the start of November. Around 10% of those gains have come just in this year and vaccine rollouts are definitely helping push prices higher as a major boost in transportation demand is seen. Renewed lockdowns may have something to say about this and derail the rally, but the surprise Saudi production cut last week was a welcome boon to crude bulls.

Some profit taking is being seen today which is unsurprising with these near-term risks and after such a stellar run. For further upside, bulls may need to keep prices above the December highs around $52.46 where prices broke out to keep the uptrend in play.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.