Presidential inauguration day is finally here!

Joe Biden will be sworn in as the 46th President of the United States today, following months of drama and defiance from Donald Trump to the outcome of the November elections.

This inauguration will be nothing short of unprecedented given the limited number of people attending because of COVID-19, Trump boycotting the ceremony, and heightened security within the vicinity.

Symbolically, the Inauguration marks the peaceful transfer of power from the current president to the next. However, given the many variables at play and the fact that Donald Trump has less than 24 hours left as president – grab your popcorn and get ready for a very eventful day ahead.

Earlier today we covered the fundamentals behind Biden’s inauguration and whether it will affect markets.

It is time for us to look at the technicals and potential trading setups ahead of this big event.

Dollar dead cat bounce…

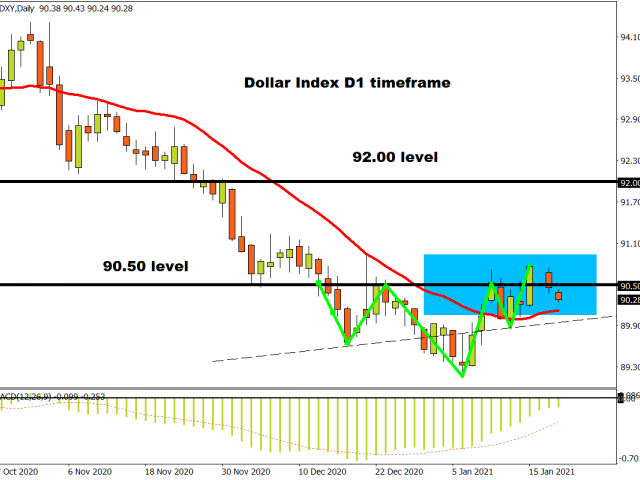

On Monday, we took a deep look at the Dollar Index (DXY) and questioned whether the rebound witnessed last week was nothing more than a dead cat bounce.

Fast forward today, the DXY failed to keep above the 90.50 level with prices approaching the 90.00 support. A breakdown below this point could open the doors back towards 89.20 and 88.30.

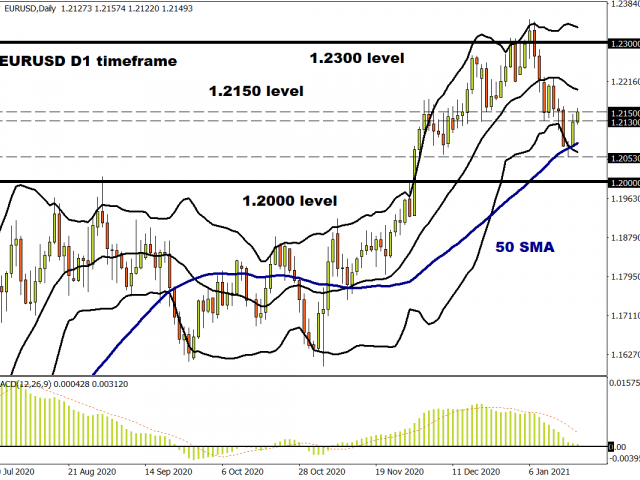

EURUSD finds support above 50 SMA

It looks like the Euro is taking advantage of a softer Dollar. The rebound from the 50 Simple Moving Average has sent prices back towards 1.2150. If the Greenback ends up weakening following Biden’s big day, this could send prices towards 1.2220 and 1.2300, respectively.

Pound eyes 1.3700

Over the past three weeks, bulls have repeatedly failed to conquer the 1.3700 resistance level.

The weekly trend on the GBPUSD is certainly bullish but it seems like Pound bulls need a kick or fresh catalyst. If prices are able to push above and secure a weekly close above 1.3700, this could open the doors towards 1.3780 and 1.4000.

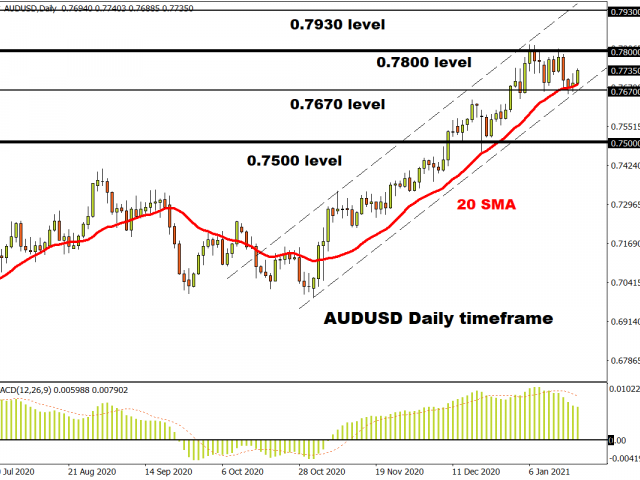

AUD trapped within a range

As the title says, the AUDUSD remains trapped within a 130 pip range with support at 0.7670 and resistance at 0.7800. Given how the trend swings in favour of bulls and lagging indicators point to further upside, the currency pair may venture towards the 0.7800 resistance level. A breakout above this point is likely to trigger an incline towards levels not seen since February 2018 around 0.7930.

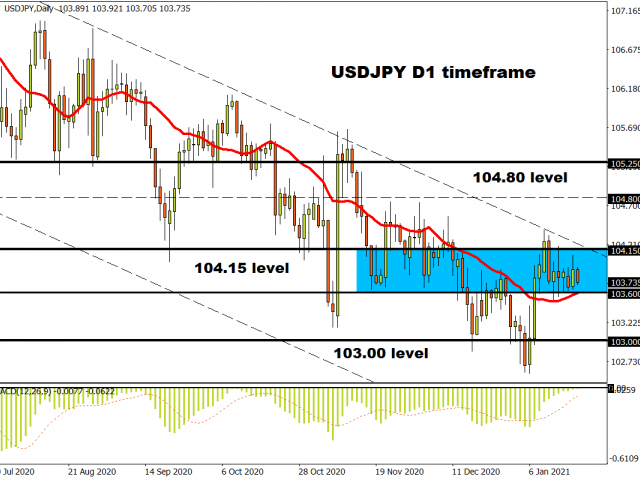

USDJPY choppy as usual

The past few days have been quite choppy for the USDJPY as prices bounced within a 55 pip range. A classic breakout/down setup is at play with support seen at 103.60 and resistance at 104.15. As stated earlier, if the Dollar ends up weakening over the next couple of days, this could drag the USDJPY below 0.7670 with the first point of interest at 103.00.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.