Global stocks are losing ground today while the Dollar is strengthening as investors take cover ahead of a busy evening later today. Bonds are bid which means yields are dropping and now closing in on the all-important 1%, a key psychological level for traders. The decline that we have seen over the past few days in yields below the intermediate support around 1.07% is paving the way for a further correction towards 0.98%.

As well the blockbuster earnings released tonight, focus will first turn to the FOMC meeting which is expected to see no changes to any policy measures. All important however, will be Chair Powell’s high wire balancing act as it seems it will be hard for the Fed to sound more dovish, but easy for it to sound more hawkish. Members appear to agree that the combination of more fiscal stimulus from the new administration, plus the vaccination campaign will drive a brighter second half economic recovery. Indeed, yesterday’s upgraded IMF growth forecast was for the most part built on the US growing 5.1% in 2021, from 3.1% in October (and this does not include President Biden’s latest package).

On the flip side, caution is expected to prevail as the near-term health of the US economy is deteriorating with a contracting jobs market and a flagging consumer. Additional fiscal stimulus also remains uncertain in terms of magnitude and timing. We must need bear in mind the Fed’s new framework of allowing inflation to rise beyond what has traditionally been acceptable in the past. The outlook has changed quite markedly since the Democrats retook control of the Senate, paving the way for some sort of stimulus package over the coming months.

Ultimately, the healthier medium-term picture will see the Fed slowing down its QE program, but Chair Powell will do his utmost to keep the genie in the bottle for at least the first quarter or so. The Fed’s ultra-accommodative policy stance is a reality check on the current Covid-19 situation, and we won’t see any front running of US Congress’ actions.

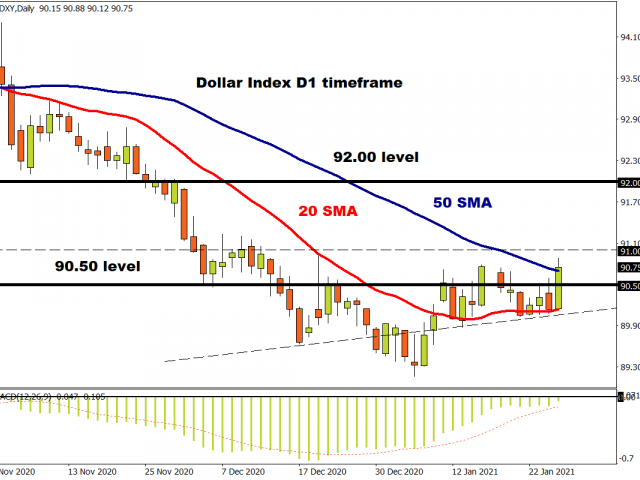

USD bid in cautious trade

DXY is pushing higher as the Euro struggles on rate cut talk and the ECB’s Knot who has suggested that the bank could act against a strengthening EUR. DXY is now approaching this month’s high at 90.95 having crossed through the 50-day SMA, with 91.00 a definite target.

Longer-term, despite the better GDP prospects for the US, the overall global rebound with global policy so loose should ensure a pick-up in non-USD assets that weakens the Dollar further out.

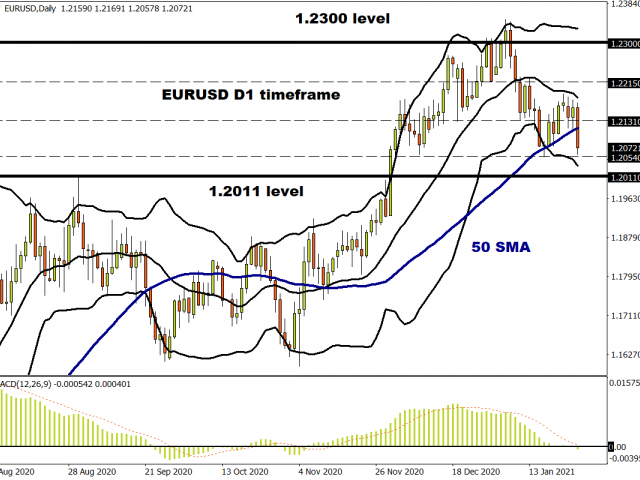

EUR/USD approaching crucial support

The world’s most traded pair is nearing its January lows and major support at 1.2054. The 50-day SMA is now in the rear-view mirror at 1.2131 so next support comes in around 1.2011 at the September high. All eyes are on the Fed this evening!

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.