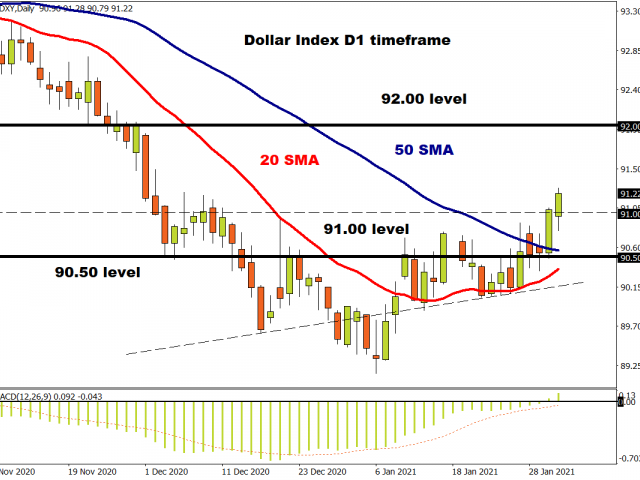

It’s one of those days where you think to yourself, “it’s one of those days today!” Whereas the dollar would normally sink to the bottom of the major currency charts when stocks are up, forex markets at least are embracing the positive risk sentiment and pushing the dollar higher. Bonds are selling off which means yields are moving higher once again with the US 10-year Treasury yield up above 1.11%. The key psychological 1% marker has certainly worked its magic as strong support over the last week.

Commodities are a mixed bag with iShares Silver Trust (#SLV) off sharply and denting the supposed power of retail traders to move markets. It does seem very strange that the Redditers picked silver to try and right the wrongs of years gone by and carry on the fight versus Wall Street. The size of the silver market towers over any single stock, most of the dealings are done off-market and ultimately, hedge funds are net long so they are the likely winners from a rising silver price. Answers on a postcard please!

It seems their 15 minutes of fame may be over now with GameStop trading over 40% lower pre-market. Are the Reddit-fuelled rallies now a footnote in history? The Vix is ten points off its highs during last week’s frenetic trading and traders have moved on and are looking to new President Biden and his proposed $1.9 trillion stimulus package, which equates to a tenth of the country’s economic output. The size of the fiscal injection is key as it will have spillover effects across the globe. That said, it’s still mightily significant even if you were to halve the size of the proposal.

Tough times for Europe

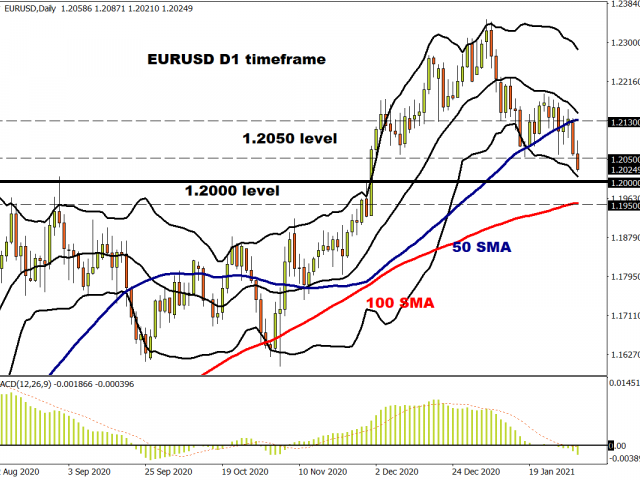

Even though this morning’s release of Eurozone GDP showed a smaller contraction of -0.7% than the expected -0.9%, the bloc is still on track to record a double-dip recession. Over the last few weeks, the single currency has been hit by a deepening economic slump with ongoing virus lockdowns, a slow pace of vaccinations and ECB members talking down their currency. Futures positions in the euro are still quite high meaning if investors reconsider, then there may be more downside to come.

On the technical side, EUR/USD looks to have breached the 50-day SMA around 1.2130 which now acts as strong resistance overhead. We are now teetering on the next support which is this year’s low around 1.2050 and the bears get the upper hand, then the 100-day SMA around 1.1950 comes into play below the psychological 1.20 level. The consensus dollar bear trade is proving taxing for some so far this year.

Oil jumps higher

Are the Reddit gang moving into oil? (I’m very much speculating here and don’t believe so…)

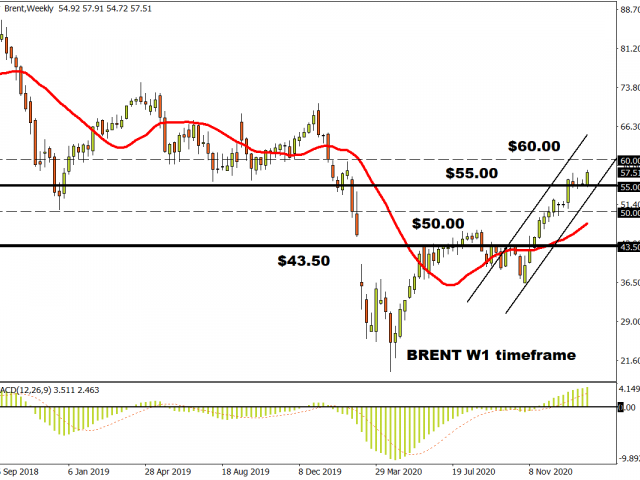

Prices are up over 6% in the last few days and hitting levels not seen since January last year. There’s no real catalyst amid mixed data from OPEC. On the bullish side, compliance with planned cuts was extremely high; on the bearish side, the cartel cuts its oil demand growth outlook to 5.6mm b/d (down from previous 5.9mm b/d).

In any event, its looks like a classic breakout after tracking sideways for most of this year. The move is very much in line with the dominant trend with the next target at $60 which is the February high from 2020. Only a drop below $54.50 would negate this strong bullish momentum.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.