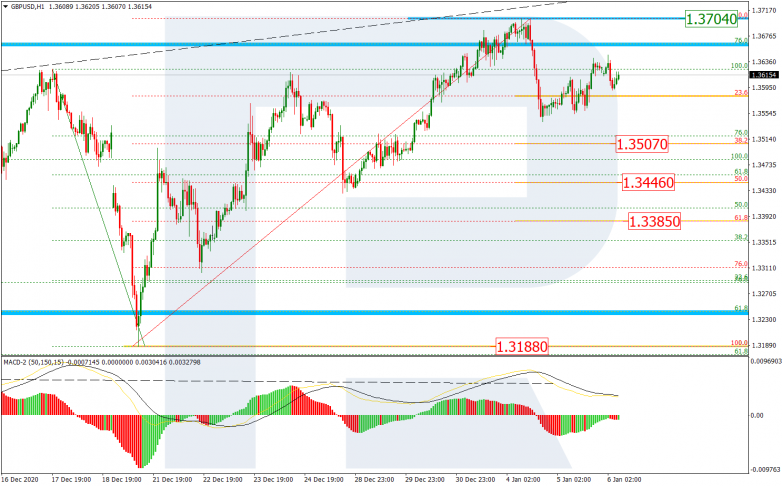

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, a divergence on MACD made the pair start a new descending correctional movement. Considering the current trend to the upside, this decline may be over soon and the asset, after breaking the high at 1.3740, will continue growing to reach the post-correctional extension area between 138.2% and 161.8% fibo at 1.3790 and 1.3980 respectively. However, an alternative scenario says that the pair may rebound from the high and start a new descending structure towards 23.6%, 38.2%, 50.0%, 61.8%, and 76.0% fibo at 1.3461, 1.3310, 1.3189, 1.3067, and 1.2922 respectively.

In the H1 chart, the price is correcting to the downside after a local divergence on MACD. The first descending impulse has reached 23.6% fibo but right now the pair is growing towards the high at 1.3704, that’s why a reversal and another descending impulse are also possible. If the asset continues falling, its targets will be at 38.2%, 50.0%, and 61.8% fibo at 1.3507, 1.3446, and 1.3385 respectively.

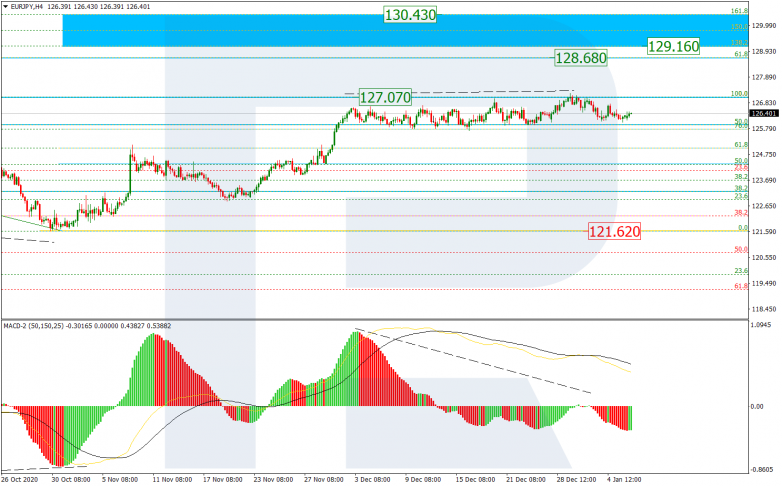

EURJPY, “Euro vs. Japanese Yen”

In the H4 chart, the situation hasn’t changed much. After rebounding from the high at 127.01 and a divergence on MACD, EURJPY is forming a new pullback. After finishing the pullback, the pair is expected to resume growing to break the mid-term 61.8% fibo at 128.65 and then continue moving to reach the post-correctional extension area between 138.2% and 161.8% fibo at 129.16 and 130.43 respectively.

The H1 chart shows a more detailed structure of the current correction after a divergence on MACD. The first wave has reached 23.6% fibo. The next targets may be 38.2% and 50.0% fibo at 125.55 and 125.04 respectively. A breakout of the local high at 127.23 will hint at further uptrend.