GBPUSD, “Great Britain Pound vs US Dollar”

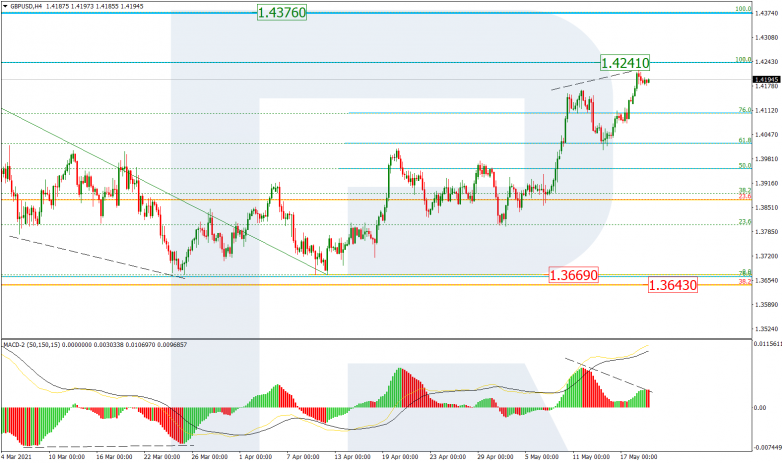

As we can see in the H4 chart, the pair continues growing towards the high at 1.4241. At the same time, despite a stable uptrend, there is a divergence on MACD, which may indicate a possible pullback after GBPUSD reaches its target level. A breakout of the local high at 1.4241 will lead to a further uptrend to reach the long-term high at 1.4376. An alternative scenario implies that the price may rebound from the high due to a divergence and resume falling to reach 38.2%, 50.0%, and 61.8% fibo at 1.3643, 1.3459, and 1.3273 respectively.

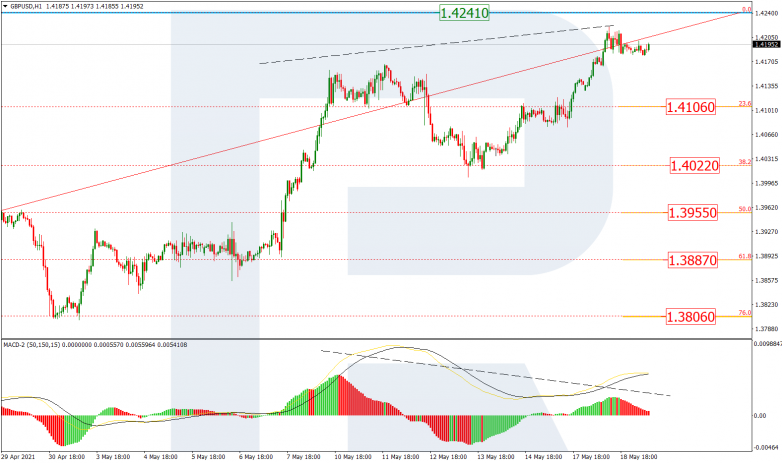

The H1 chart shows a more detailed structure of the current growth and a divergence on MACD, as well as potential correctional targets, which are 23.6%, 38.2%, 50.0%, 61.8%, and 76.0% fibo at 1.4106, 1.4022, 1.3955, 1.3887, and 1.3806 respectively.

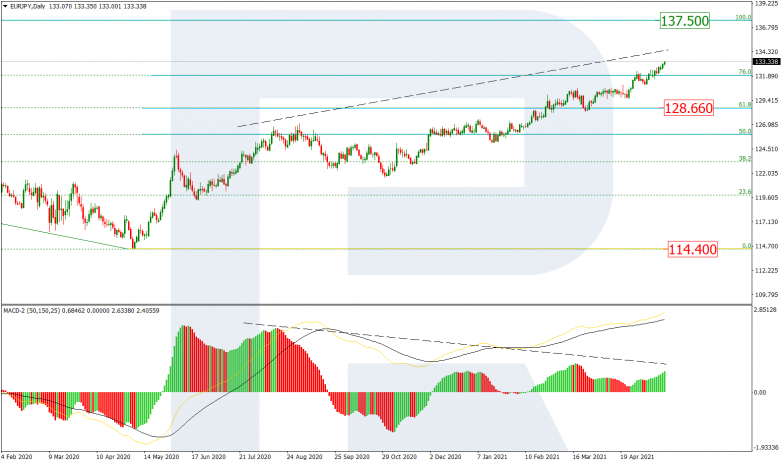

EURJPY, “Euro vs. Japanese Yen”

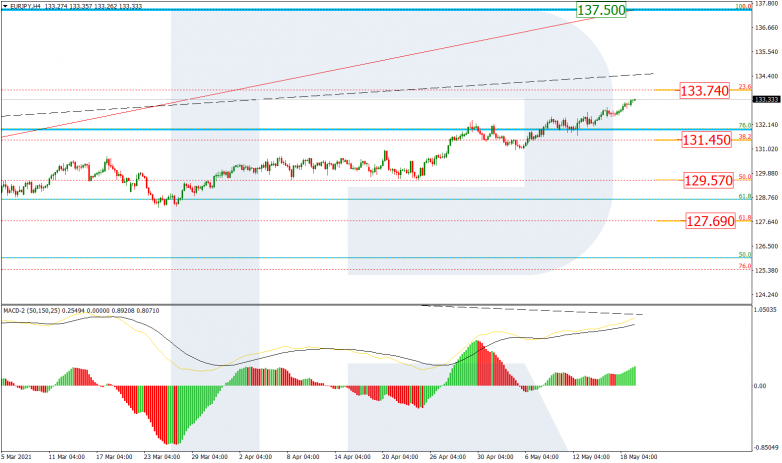

The H4 chart shows possible correctional targets after a divergence on MACD – 23.6%, 38.2%, 50.0%, and 61.8% fibo at 133.74, 131.45, 129.57, and 127.69 respectively.