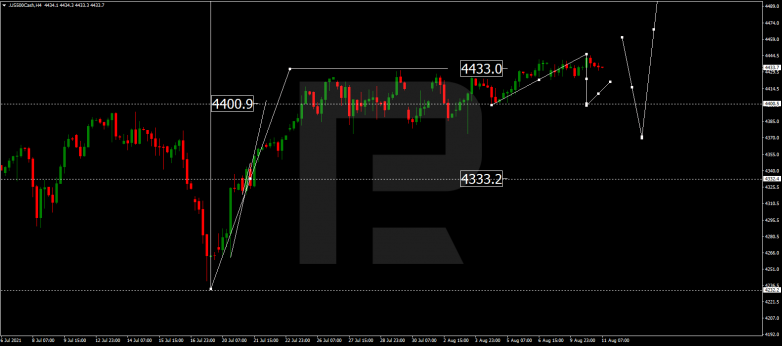

EURUSD, “Euro vs US Dollar”

The currency pair has bounced off 1.1767 and keeps trading in a structure of a declining wave. Today a link of growth to 1.1740 (a test from below) is not excluded. Then the downtrend should continue. The next goal is 1.1680. After this one is reached, we expect a consolidation range to develop. With an escape upwards, the pair might correct to 1.1767. With an escape downwards, a pathway to 1.1600 should open.

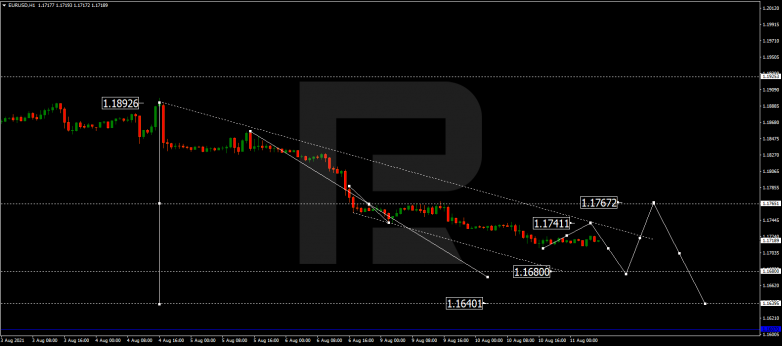

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair keeps forming a consolidation range around 1.3848. Today it has been extended to 1.3818. A technical return to 1.3848 is not excluded (a test from below), followed by a decline to 1.3800. Practically we have a pattern of downward trend cintinuation. The aim of 1.3750 is local.

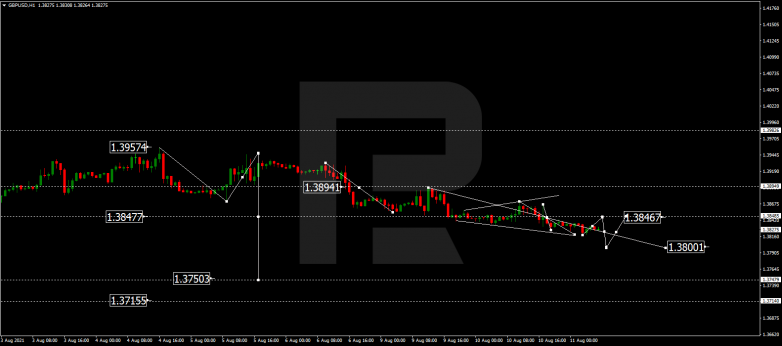

USDRUB, “US Dollar vs Russian Ruble”

The currency pair keeps developing a correction. Today there might be a link of decline to 73.55. Then another structure of growth to 74.10 should develop (a test from below). Then we should expect a wave of decline to 73.40.

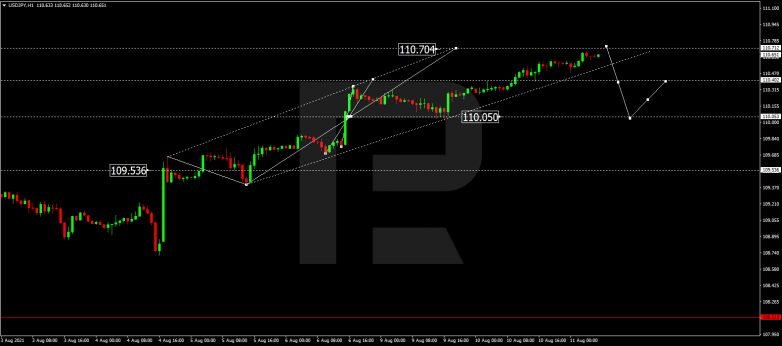

USDJPY, “US Dollar vs Japanese Yen”

The currency pair keeps being pushed upwards to 110.70. After this, a correction to 110.00 should begin (a test from above). Then another structure of growth to 111.30 is expected.

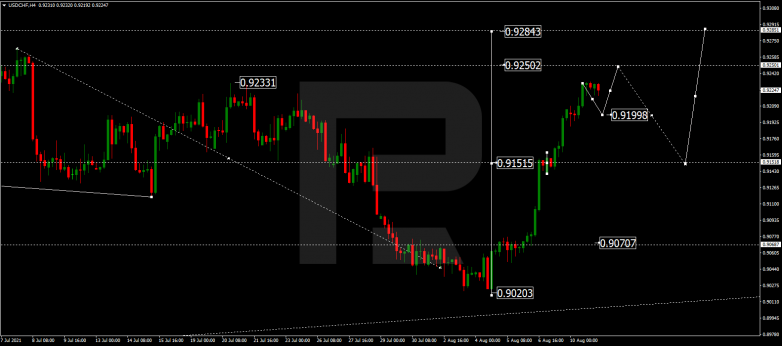

USDCHF, “US Dollar vs Swiss Franc”

The currency pair goes on developing a structure of growth to 0.9250. Today a link of decline to 0.9200 (a test from above) is not excluded, followed by growth to 0.9250. The goal is local. When this level is reached, a correction to 0.9151 should begin, followed by growth to 0.9284. The goal is first by the trend upwards.

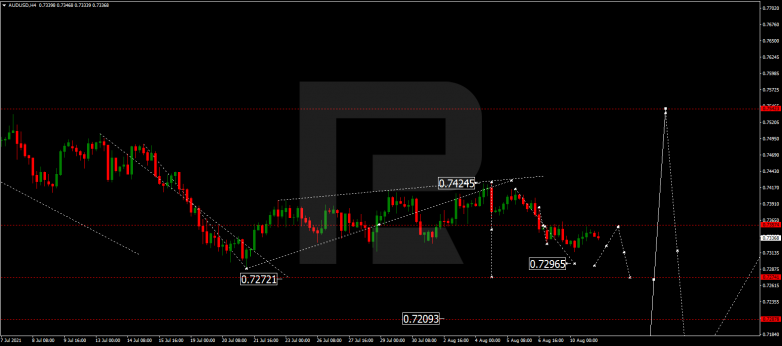

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair formed a consolidation range around 0.7360 and escaped it downwards. There is a potential for a decline to 0.7272. Yesterday the market extended the range to 0.7314. Today a technical test of 0.7358 from below is not excluded, followed by a decline to 0.7296. The goal is local in a wave of decline.

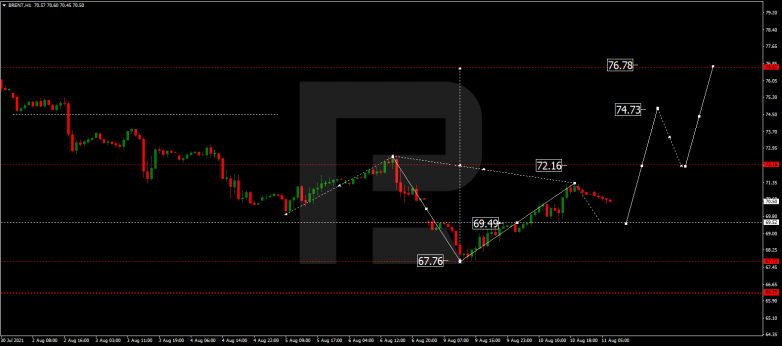

BRENT

Oil completed an impulse of growth to 71.33. Today a link of correction to 69.50 might be expected, followed by growth to 72.20. With a breakaway of this level upwards, a pathway to 74.74 should open. The goal is local.

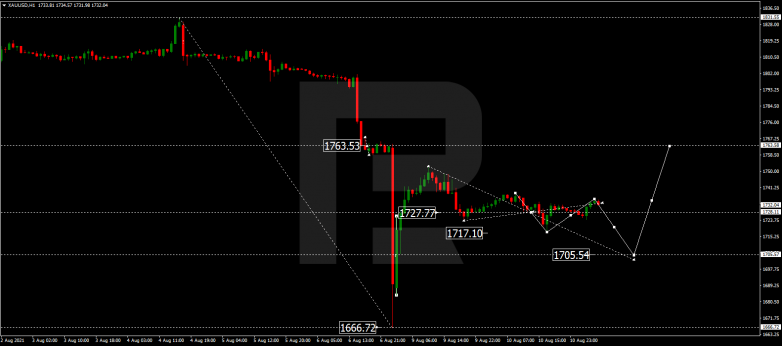

XAUUSD, “Gold vs US Dollar”

Gold extended the range to 1717.10 and today returned to 1735.00. We expect another structure of decline to develop to 1705.55. Here the correction will be over. Then the next wave of growth to 1763.60 should start.

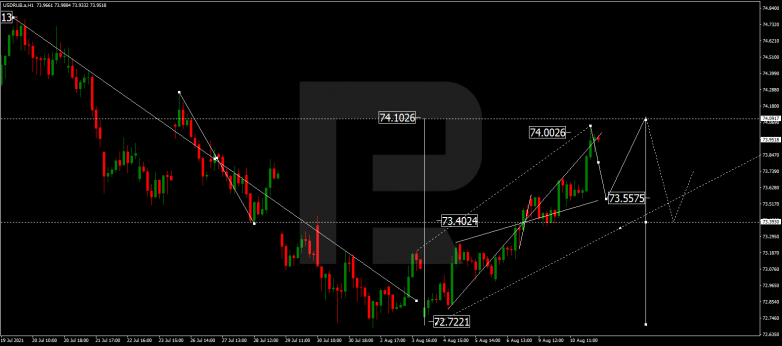

S&P 500

The stock index has extended the consolidation range to 4445.8. Today the market is trading in a structure of another impulse of decline to 4400.0, followed by growth to 4422.0. At these levels, we expect a new consolidation range to form. With an escape downwards, a decline to 4000.0 is likely to start. With an escape upwards, a pathway to 4500.0 will open.