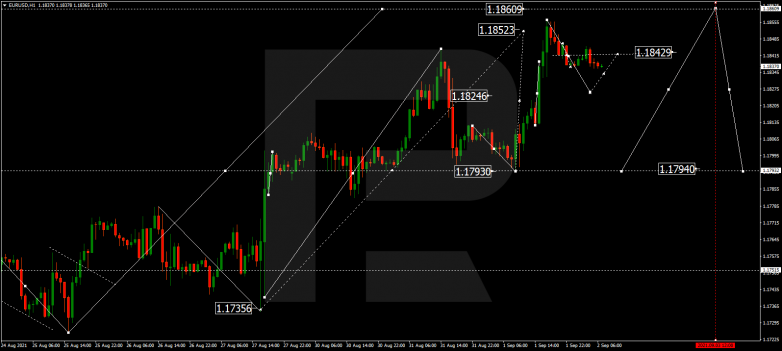

EURUSD, “Euro vs US Dollar”

After rebounding from 1.1730, finishing the ascending structure at 1.1822, and then forming a new consolidation range around the latter level, EURUSD has broken it to the upside to reach 1.1855. Today, the pair may correct to test 1.1827 from above and then resume trading upwards to reach 1.1860. Later, the market may start a new correction with the target at 1.1793.

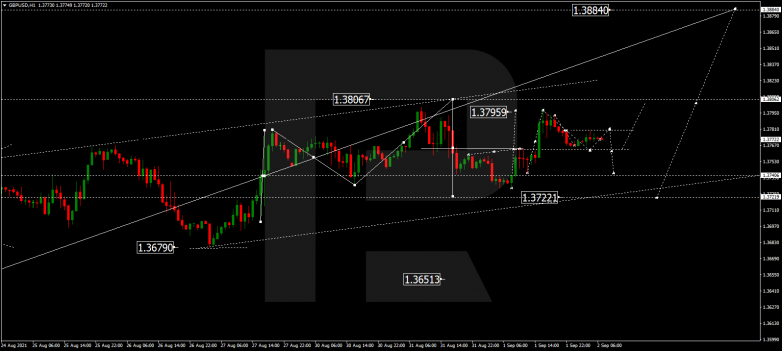

GBPUSD, “Great Britain Pound vs US Dollar”

After rebounding from 1.3730, finishing the ascending structure at 1.3760, GBPUSD has broken the latter level to the upside to reach 1.3795. Possibly, today the pair may start another decline to test 1.3760 from above and then form one more ascending structure with the target at 1.3810. After that, the instrument may resume falling towards 1.3720.

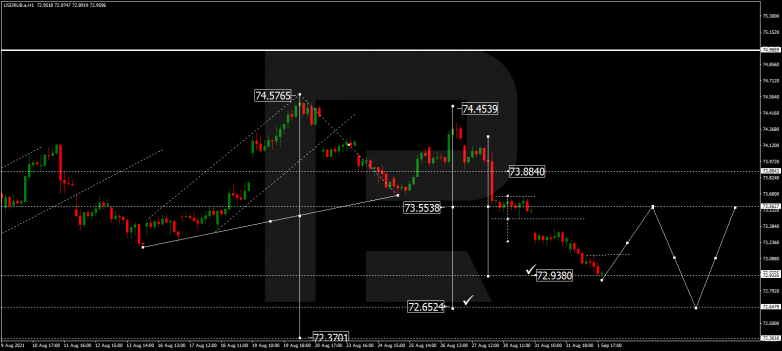

USDRUB, “US Dollar vs Russian Ruble”

USDRUB has completed the descending structure at 72.93. Today, the pair may consolidate around this level. Later, the market may break the range to the upside and correct to reach 73.93. Later, the market may resume trading downwards with the target at 72.65.

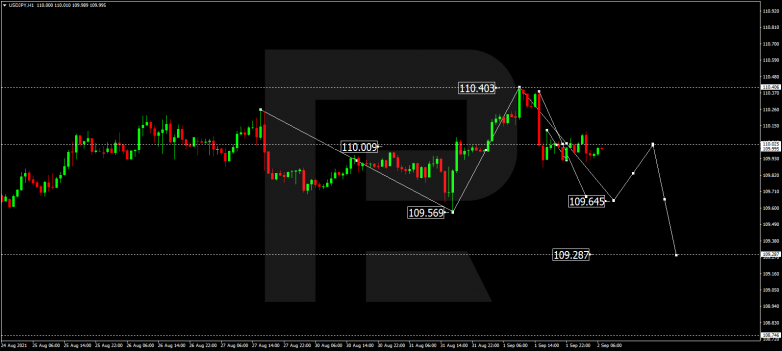

USDJPY, “US Dollar vs Japanese Yen”

After expanding the range up to 110.40 and then rebounding from this level, USDJPY has returned to the centre at 110.00. Possibly, today the pair may form a new descending structure to break 109.60 and then continue falling with the target at 109.25.

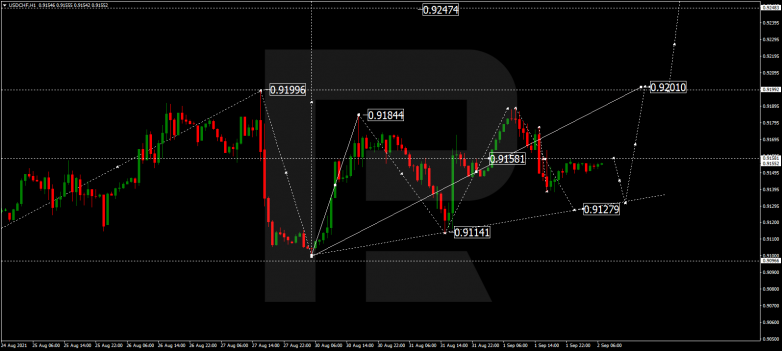

USDCHF, “US Dollar vs Swiss Franc”

USDCHF is consolidating around 0.9158 and may later form a new descending structure towards 0.9128. After that, the instrument may resume trading upwards with the target at 0.9202.

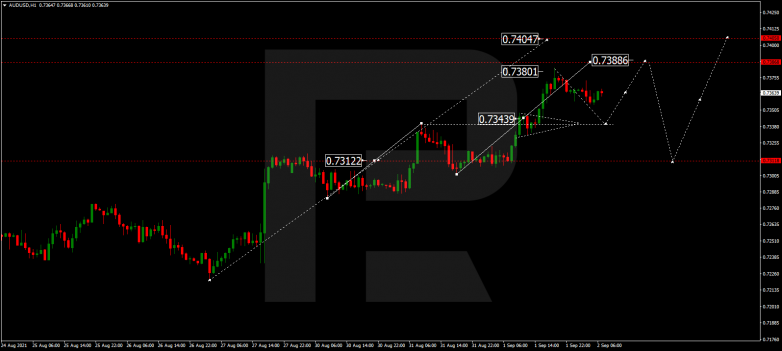

AUDUSD, “Australian Dollar vs US Dollar”

After breaking 0.7343, AUDUSD has reached 0.7380. Possibly, today the pair may fall towards 0.7350 and then start another growth with the target at 0.7388.

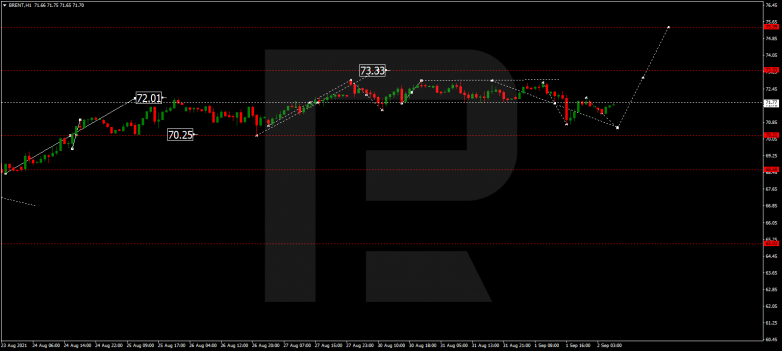

BRENT

Brent is still consolidating around 72.00. Possibly, the asset may fall to reach 70.60 and then start a new growth to break 72.55. After that, the instrument may continue trading upwards with the target at 75.30.

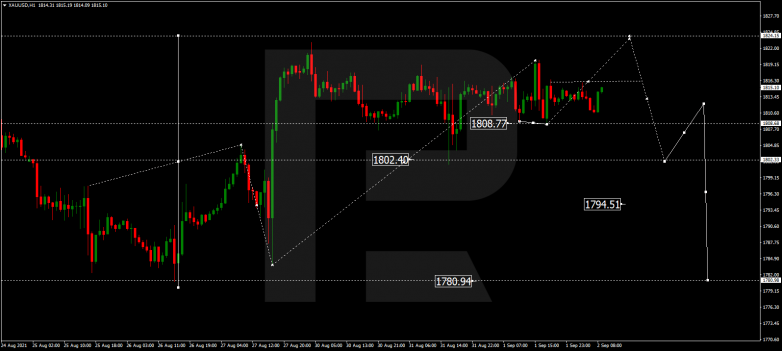

XAUUSD, “Gold vs US Dollar”

Gold is consolidating around 1812.66. Possibly, today the metal may start another growth towards 1824.15 and then resume trading downwards to break 1802.40. Later, the market may continue the correction with the target at 1780.00.

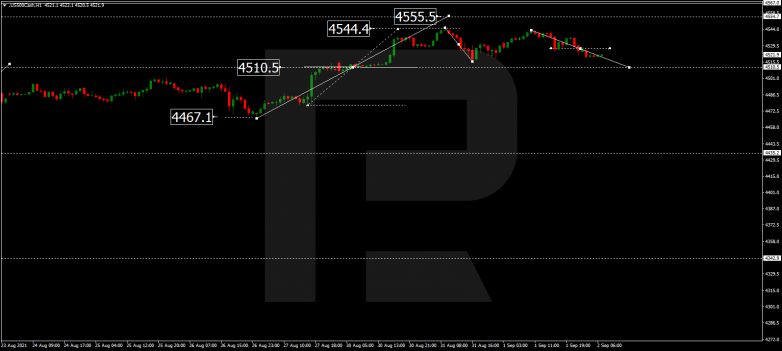

S&P 500

The S&P index is consolidating around 4525.0. Today, the asset may expand the range down to 4510.5 and then form one more ascending structure with the target at 4555.5.