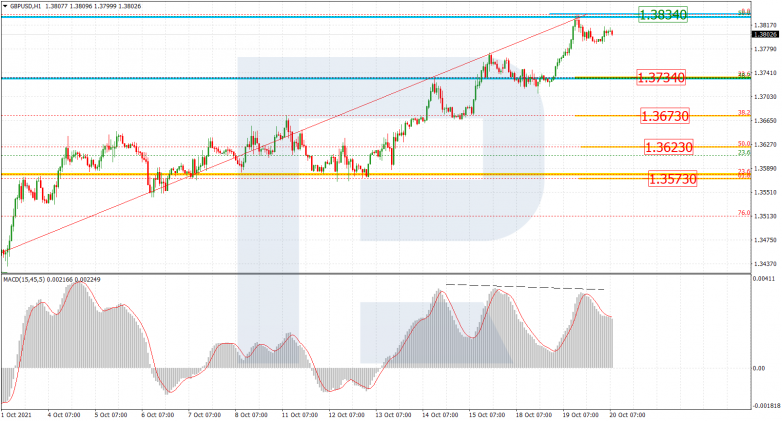

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, the correctional uptrend is looking quite stable and has already reached 50.0% fibo. In the future, it may continue towards 61.8% and 76.0% fibo at 1.3929 and 1.4048 respectively. The key resistance remains at the high at 1.4250. However, another scenario implies that the asset may finish the correction and start a new descending impulse towards 38.2% and 50.0% fibo at 1.3166 and 1.2830 respectively, but only after breaking the low at 1.3412.

The H1 chart shows divergence on MACD and possible correctional targets, which are 23.6%, 38.2%, 50.0%, and 61.8% fibo at 1.3734, 1.3673, 1.3623, and 1.3573 respectively. A breakout of the local high at 1.3834 may lead to a further uptrend.

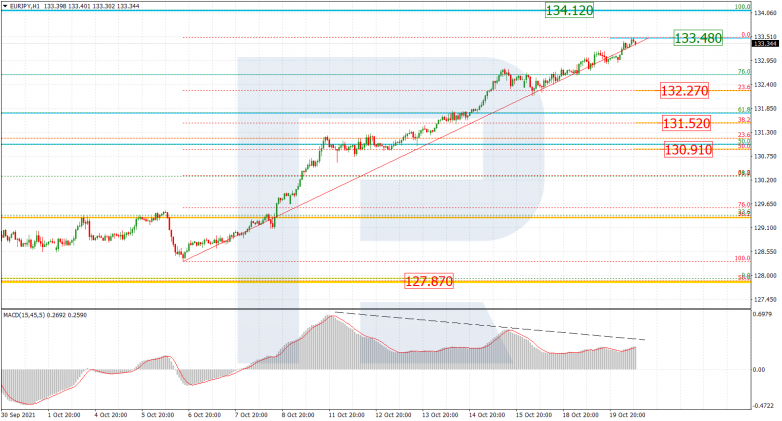

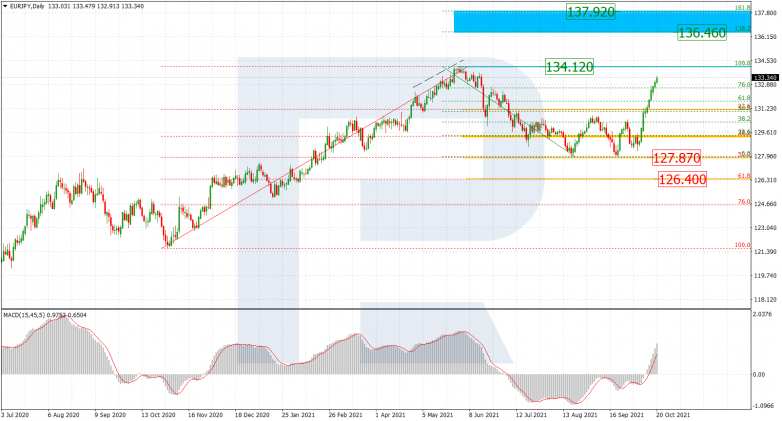

EURJPY, “Euro vs. Japanese Yen”

In the daily chart, after completing the correctional downtrend at 50.0% fibo at 127.87, EURJPY is forming a new impulse to the upside towards the high at 134.12 and may soon break it. In this case, the asset may continue growing to reach the post-correctional extension area between 138.2% and 161.8% fibo at 136.46 and 137.92 respectively. Another scenario implies that the pair may rebound from the high and resume falling but this idea is highly unlikely.

The H1 chart shows local divergence on MACD and the start of a new pullback. In this case, the correctional targets may be 23.6%, 38.2%, and 50.0% fibo at 132.27, 131.52, and 130.91 respectively. The local resistance is the high at 133.48.