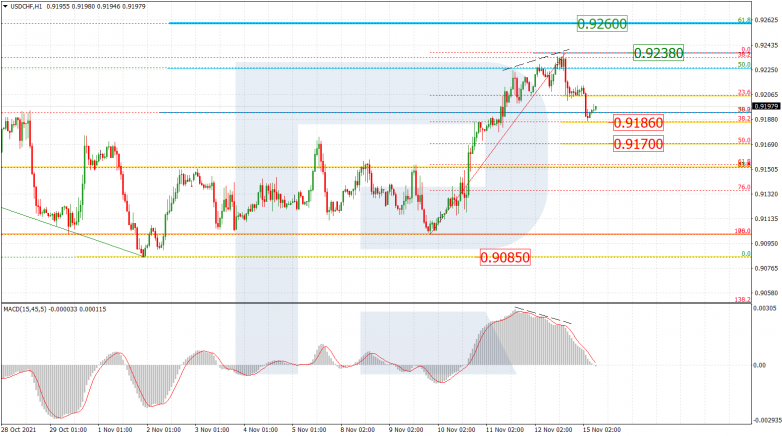

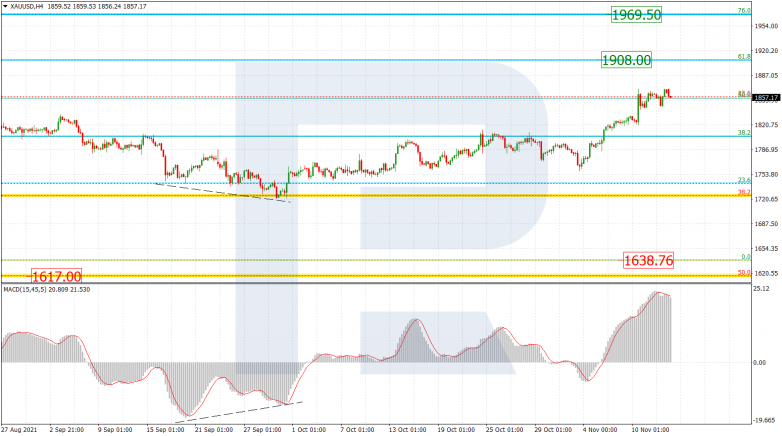

XAUUSD, “Gold vs US Dollar”

In the H4 chart, after reaching 50.0% fibo, XAUUSD is correcting around this level. After the correction is over, the next upside targets may be 61.8% and 76.0% fibo at 1908.00 and 1969.50 respectively. However, the key upside target is the all-time high at 2074.75. The key support is the low at 1638.76.

The H1 chart shows a more detailed structure of the current correction and its targets, which are 23.6%, 38.2%, and 50.0% fibo at 1842.72, 1826.75, and 1814.00 respectively. A breakout of the local resistance at 1868.92 will result in a further uptrend towards the short-term post-correctional extension area between 138.2% and 161.8% fibo at 1876.75 and 1903.00 respectively.

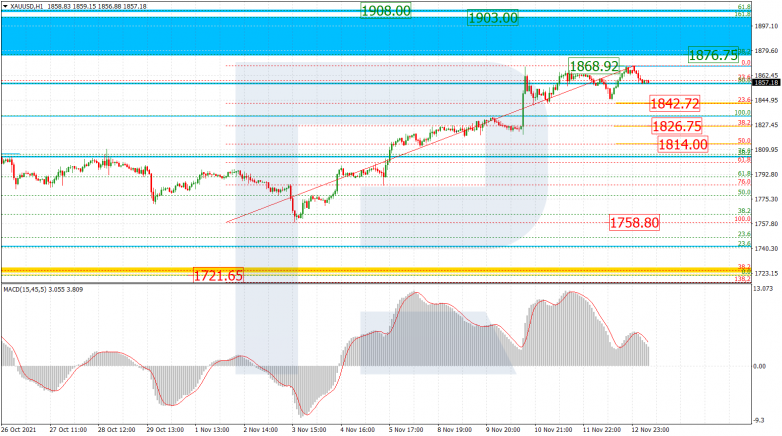

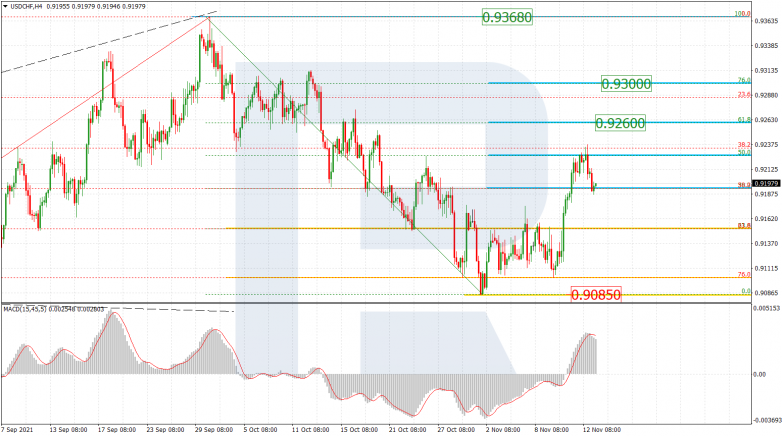

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, after completing the rising wave at 50.0% fibo, the asset has started a new pullback. After the pullback is over, the pair may resume growing towards 61.8% and 76.0% fibo at 0.9260 and 0.9300 respectively. The key upside target is the high at 0.9368, while the key support is at 0.9085.

In the H1 chart, divergence on MACD made the pair start a new pullback, which is now testing 38.2% fibo at 0.9186. The next downside target will be 50.0% fibo at 0.9170. The resistance is at 0.9238.