GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, the situation hasn’t changed much over the past week. After attempting to test the long-term 38.2% fibo at 1.3166, the asset was moving upwards to reach 23.6% fibo 1.3345. At the moment, the price is falling again to test the low at 1.3194 and break it. However, one shouldn’t exclude a possibility of a rebound from the low and a new ascending wave. The key resistance remains at 1.3834.

The H1 chart shows a more detailed structure of the current consolidation range. If the asset fails to break the low, the rising correction may continue towards 38.2% and 50.0% fibo at 1.3438 and 1.3514 respectively.

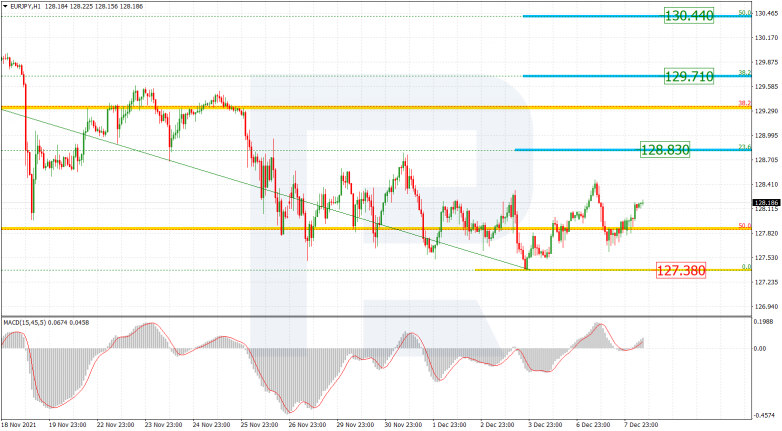

EURJPY, “Euro vs. Japanese Yen”

As we can see in the H4 chart, after reaching 50.0% fibo, EURJPY is consolidating. Convergence on MACD may hint at a possible short-term pullback soon. After the pullback is over, the asset may resume falling towards 61.8% fibo at 126.40.

The H1 chart shows the upside correctional targets are 23.6%, 38.2%, and 50.0% fibo at 128.83, 129.71, and 130.44 respectively. The support is the low at 127.49.