XAUUSD, “Gold vs US Dollar”

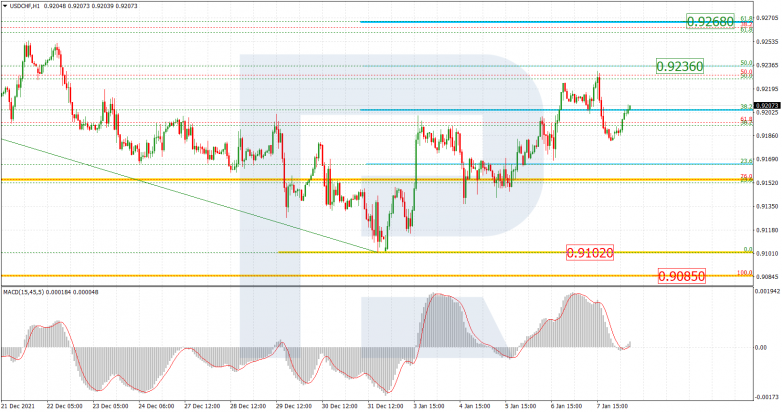

In the H4 chart, after finishing the correctional uptrend at 61.8% fibo, XAUUSD is trying to form a new wave to the downside towards the low at 1752.50, a breakout of which may lead to a further downtrend towards 61.8% and 76.0% fibo at 1729.90 and 1696.13 respectively. The local resistance is at 1831.66.

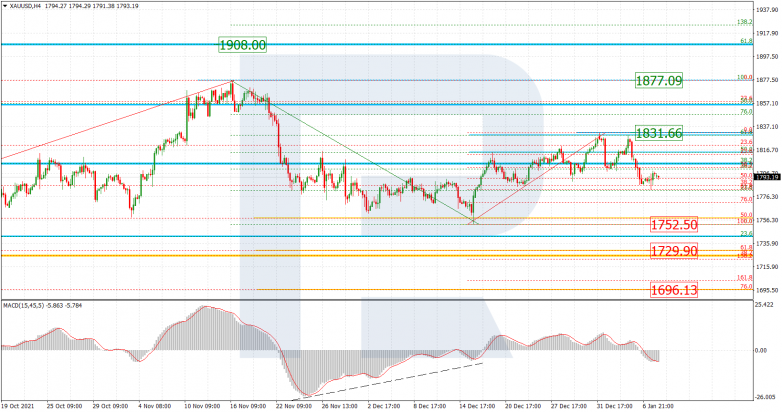

As we can see in the H1 chart, the asset has reached 61.8% fibo. In the nearest future, the pair may form a slight pullback and then resume falling to break 76.0% fibo at 1771.50. Later, the market may continue falling to reach the low.

USDCHF, “US Dollar vs Swiss Franc”

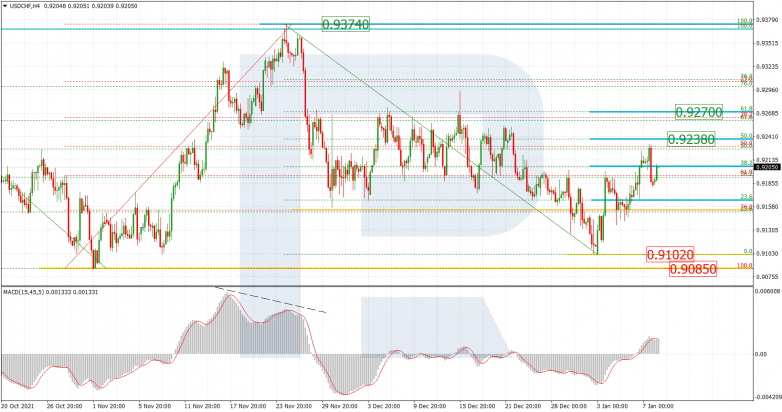

As we can see in the H4 chart, the asset is forming a new wave to the upside after convergence on MACD; it has already reached 38.2% fibo and may later continue towards 50.0% and 61.8% fibo at 0.9238 and 0.9270 respectively. However, the key upside target is the high at 0.9374, while the key support is at 0.9085.

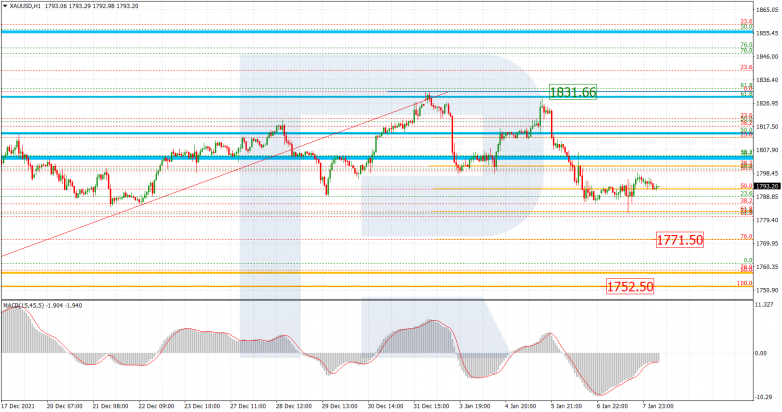

In the H1 chart, having completed the pullback, USDCHF is growing to reach 50.0% fibo at 0.9236. The local support is the low at 0.9102.