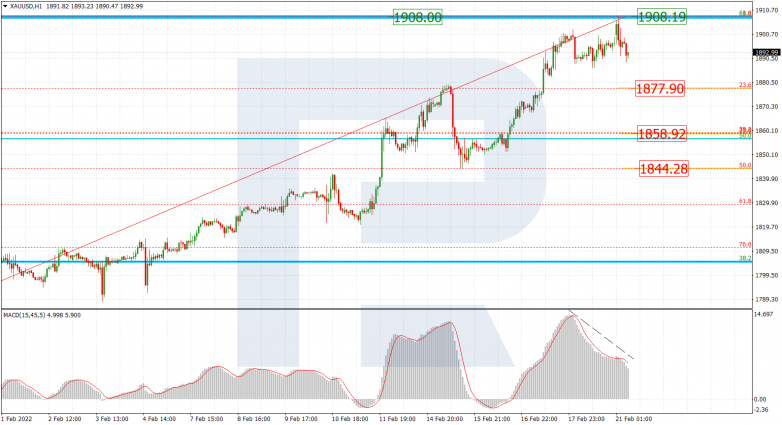

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, the asset is testing the mid-term 61.8% fibo at 1908.00. Possibly, the pair may rebound and form a slight pullback, which may later be followed by a further uptrend. The next upside target is 76.0% fibo at 1969.00.

The H1 chart shows that the pair is forming a short-term correction after divergence on MACD. The correctional targets are 23.6%, 38.2%, and 50.0% fibo at 1877.90, 1858.92, and 1844.28 respectively. If the price breaks the high at 1908.19, the asset may resume its mid-term uptrend.

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, after breaking the consolidation range to the downside, USDCHF is moving downwards to reach 76.0% fibo at 0.9164. At the same time, the key downside targets are the local and mid-term lows at 0.9108 and 0.9092 respectively. However, if the price rebounds from 76.0% fibo, the asset may resume growing to break the local high at 0.9343 and reach the key one at 0.9374.

In the H1 chart, the pair is consolidating and testing 61.8% fibo. In this case, the asset is expected to break the range to the downside and resume falling.