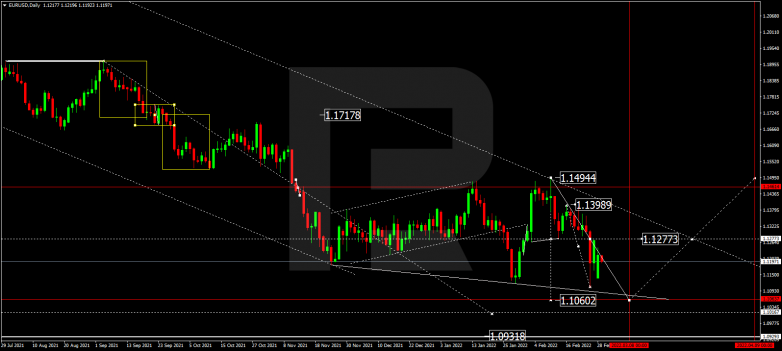

EURUSD, “Euro vs US Dollar”

As we can see in the daily chart, having completed the correction at 1.1494, EURUSD is falling; it has already formed the descending structure with the short-term target at 1.1106 along with another correction to reach 1.1270. Possibly, the pair may rebound from this level and start a new decline towards 1.1060. Later, the market may resume trading upwards to break 1.1277 and then continue growing with the target at 1.1500.

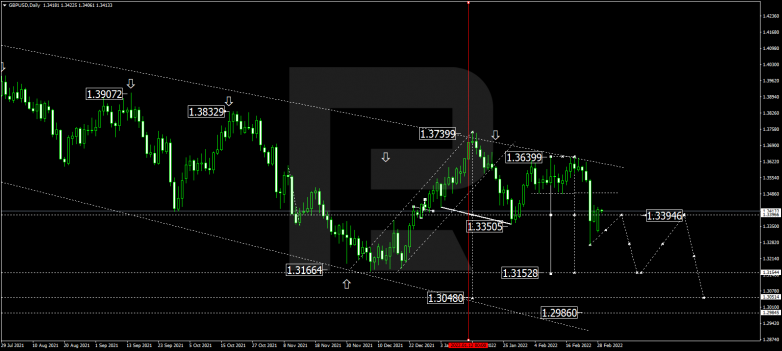

GBPUSD, “Great Britain Pound vs US Dollar”

In the daily chart, after forming a new consolidation range around 1.3639, breaking 1.3490, GBPUSD continues trading downwards with the short-term target at 1.3153; it has already completed the descending structure at 1.3390 and right now, is forming another consolidation range around the latter level. Possibly, the pair may soon break 1.3350 and resume falling to reach the above-mentioned target. Later, the market may correct to test 1.3394 from below and then start another decline to reach 1.3051.

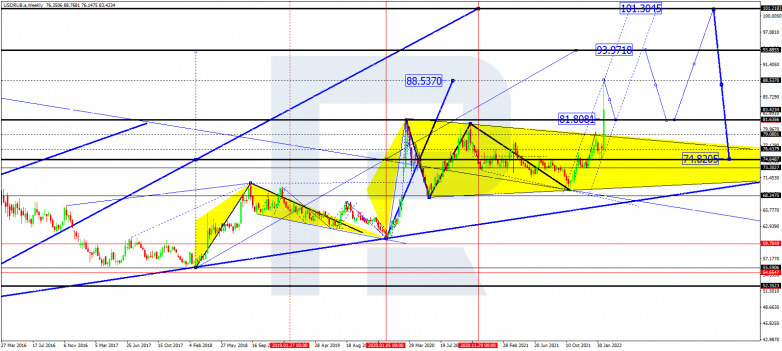

USDRUB, “US Dollar vs Russian Ruble”

As we can see in the daily chart, sanctions made USDRUB skyrocket to 88.50; by now, it has completed the correction down to 82.00 along with the ascending impulse towards 101.30. The pair is expected to wait until all fundamental factors are over and then return to 75.00.

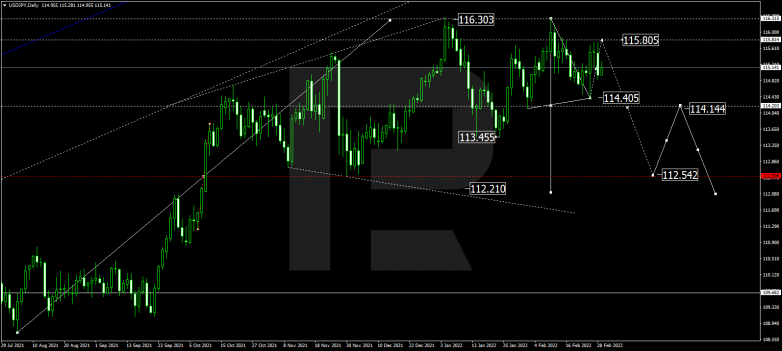

USDJPY, “US Dollar vs Japanese Yen”

In the daily chart, USDJPY has finished the first descending wave at 114.40; right now, it is correcting towards 115.80. Later, the market may start a new decline to break 114.14 and then continue trading downwards with the short-term target is at 112.55.

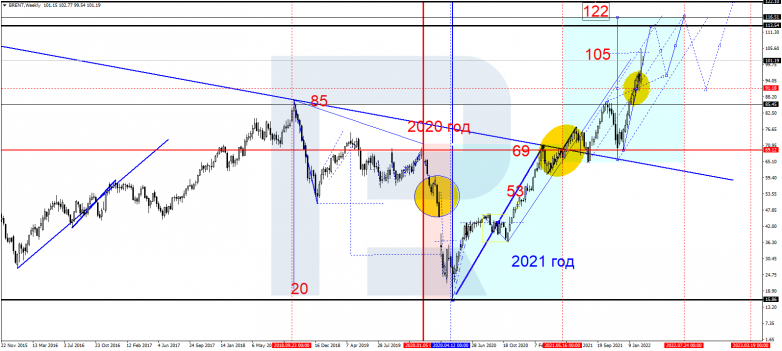

BRENT

As we can see in the daily chart, Brent has broken 91.00 to the upside; right now, it is still growing towards 103.50. Later, the market may start another correction to test 91.00 from above and then resume trading upwards with the target at 116.50.

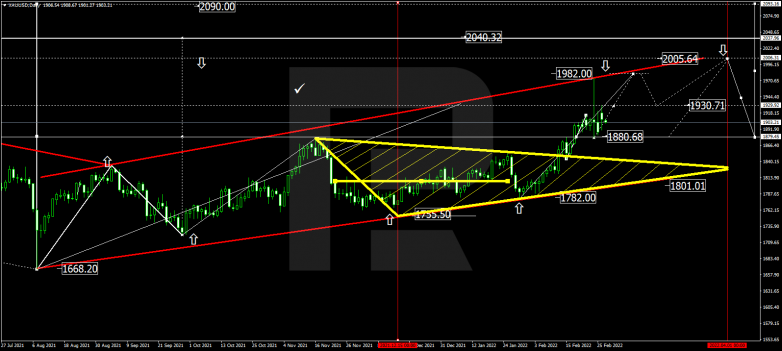

XAUUSD, “Gold vs US Dollar”

In the daily chart, after finishing the ascending structure at 1973.70 along with the correction towards 1880.700, Gold is expected to grow and break 1930.70. After that, the instrument may form one more ascending structure with the short-term target at 1982.00 and then start a new correction to return to 1930.00. Later, the asset may resume trading upwards to reach 2005.60.

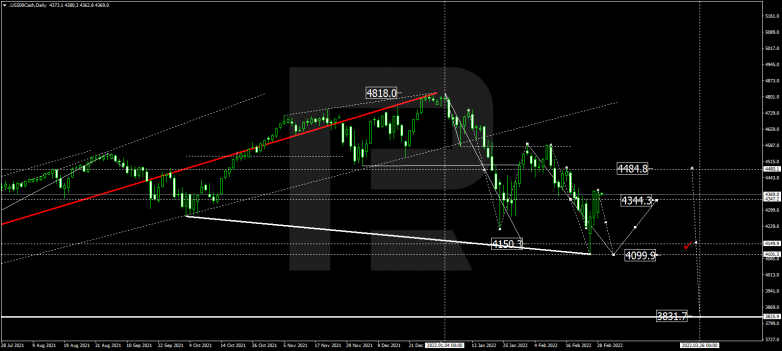

S&P 500

In the daily chart, the S&P index is forming the fifth descending wave towards 4100.0. Later, the market may correct to reach 4480.0 and then start a new decline with the target at 3830.0.