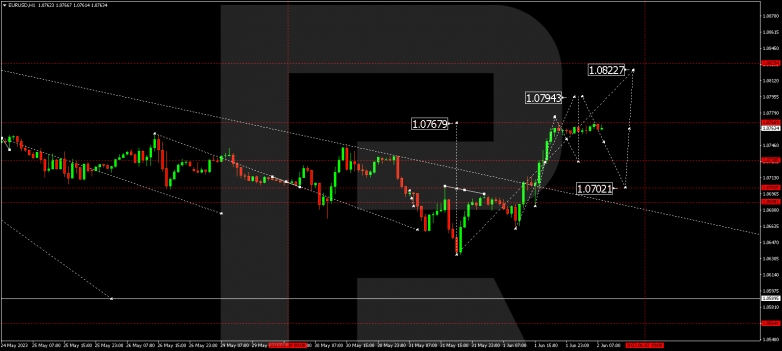

EURUSD, “Euro vs US Dollar”

The currency pair has formed a consolidation range around 1.0730 and suggests a correction to 1.0743 with a breakout from the range upwards. After the price reaches this level, a link of decline to 1.0702 is expected, followed by a rise to 1.0822.

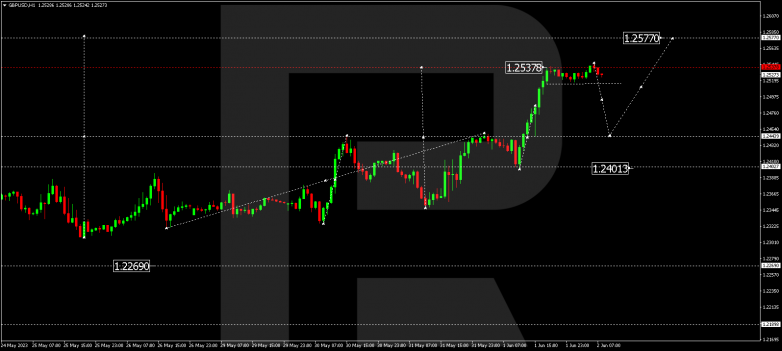

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair formed a consolidation range around 1.2444 and, escaping it upwards, completed a structure of growth to 1.2540. Today it might decline to 1.2444 and rise to 1.2577.

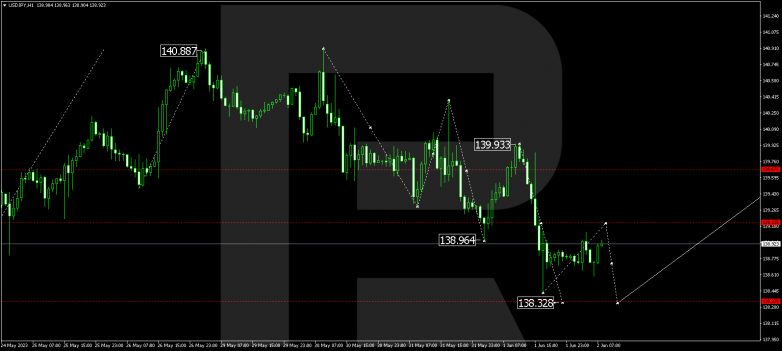

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has completed a structure of decline to 138.44. A structure of growth to 139.13 might follow today. Next, a decline to 138.32 can be expected. After the price reaches this level, a wave of growth to 139.99 might start.

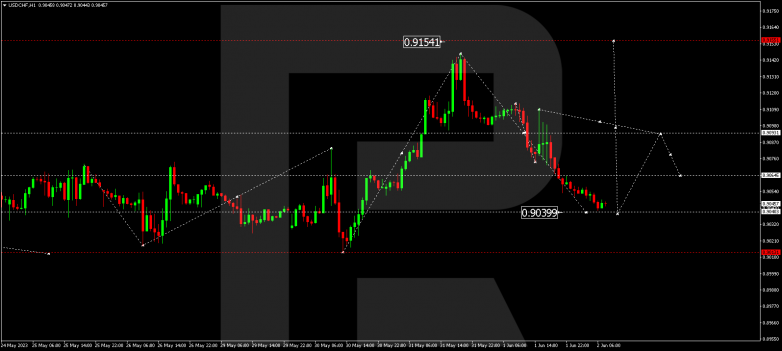

USDCHF, “US Dollar vs Swiss Franc”

The currency pair has formed a consolidation range around 0.9093 and, escaping it downwards, continues developing a corrective structure to 0.9040. After the price reaches this level, a link of growth to 0.9111 could start.

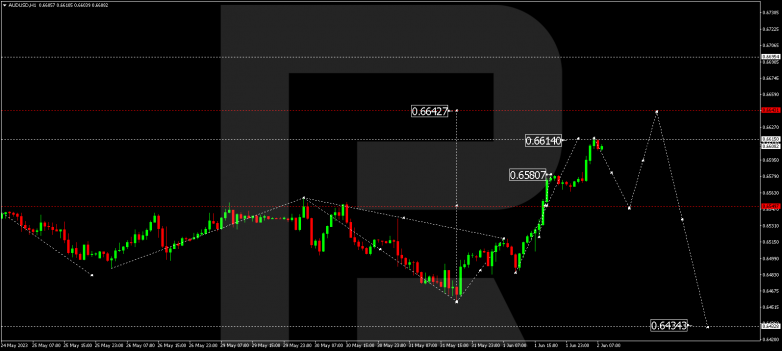

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has formed a consolidation range around 0.6550 and, escaping it upwards, is developing a structure of growth to 0.6614. After the quotes reach the level, a link of decline to 0.6550 might form, followed by a link of growth to 0.6644.

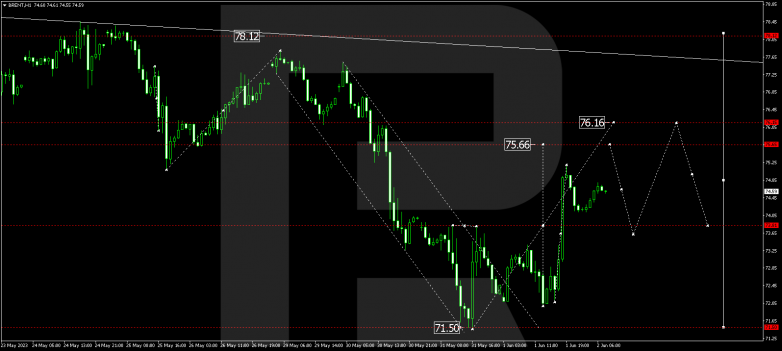

BRENT

Brent has broken 73.83 upwards and continues developing a wave of growth to 75.66. After the price reaches this level, a decline to 73.83 and a rise to 76.16 could follow. This is the first target.

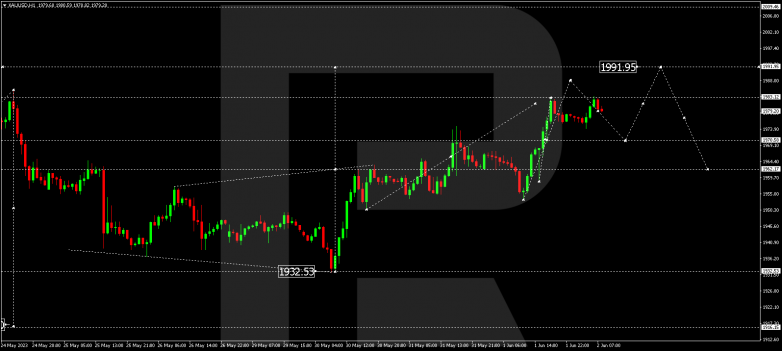

XAUUSD, “Gold vs US Dollar”

Gold has formed a consolidation range around 1970.60 and continues growing to 1980.00. After the price reaches this level, a link of decline to 1970.60 could be expected, followed by a rise to 1991.91 and a decline to 1962.00.

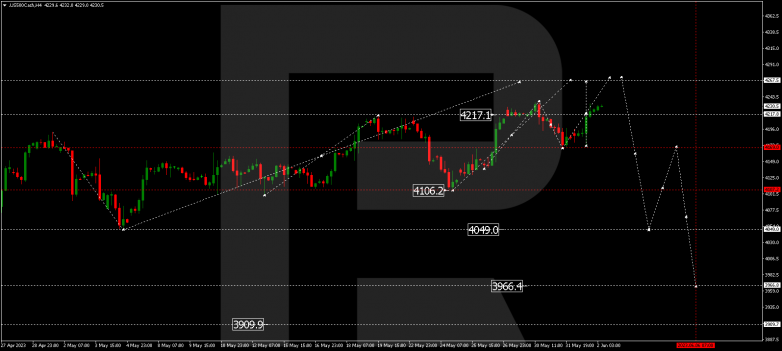

S&P 500

The stock index continues developing a consolidation range around 4217.8. Today the range could extend upwards to 4267.5. Next, a decline to 4170.0 might follow. And if this level also breaks, the potential for a decline by the downtrend to 4049.0 might open. This is the first target.