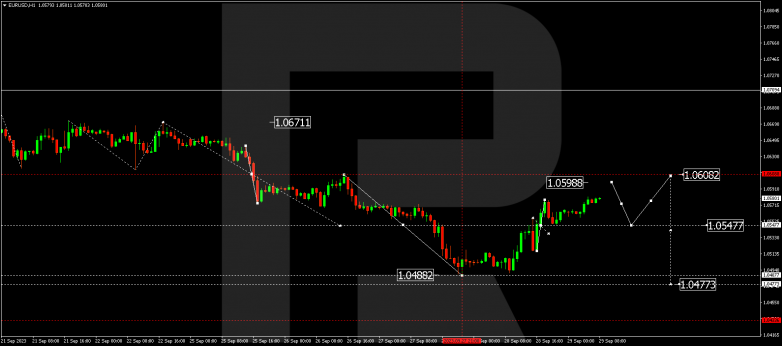

EURUSD, “Euro vs US Dollar”

EURUSD has performed a growth movement to 1.0545. Today the market is forming a consolidation range above this level. Escaping the range downwards, the potential for a wave to 1.0477 could open. With an escape upwards, a link of correction to 1.0600 will not be excluded (with a test from below). Next, a decline to 1.0477 might follow.

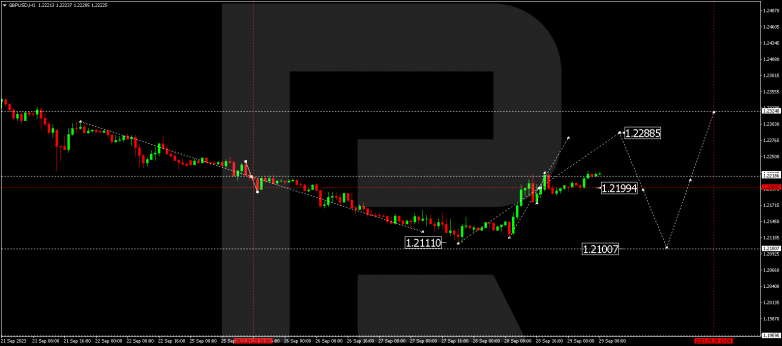

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has performed a growth movement to 1.2199. Today the market is forming a consolidation range above this level. Escaping the range downwards, the potential for a wave to 1.2100 could open. With an escape upwards, a link of correction to 1.2288 will not be excluded (with a test from below). Next, a decline to 1.2100 might follow.

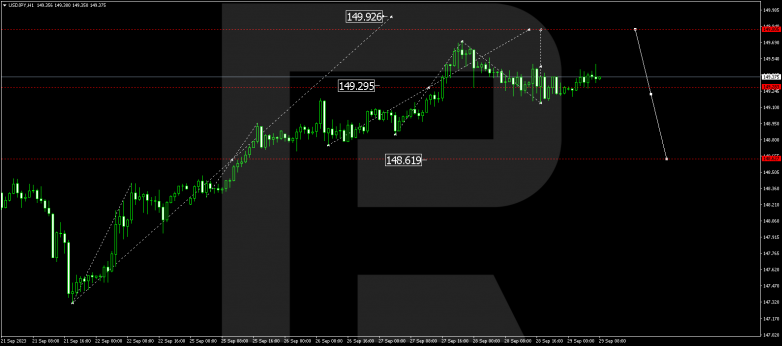

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is forming a consolidation range around 149.28. With an escape from the range downwards, the correction might continue to 148.62. With an escape upwards, the trend might continue to 149.88.

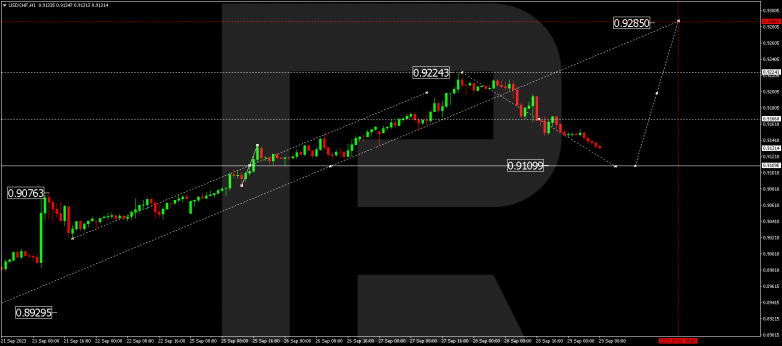

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has completed a wave of correction to 0.9166. Today the market has formed a consolidation range around this level. With an escape downwards, the potential for a correction to 0.9110 might open. After the correction will be over, the trend could continue to 0.9285.

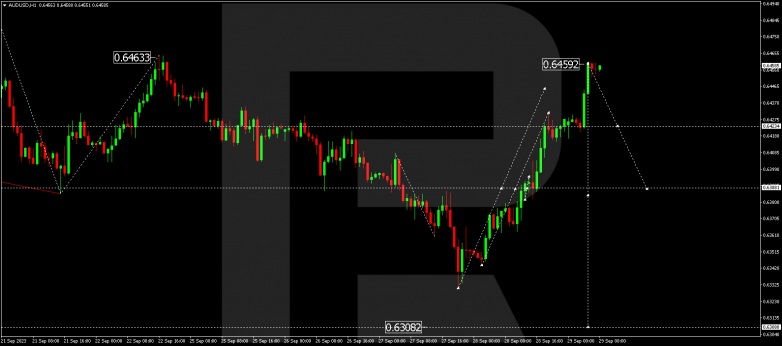

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has completed a wave of correction to 0.6460. Today the market is forming a consolidation range under this level. With an escape from the range downwards, a decline to 0.6388 could follow. And with a breakout of this level, the potential for a decline by the trend to 0.6300 might open.

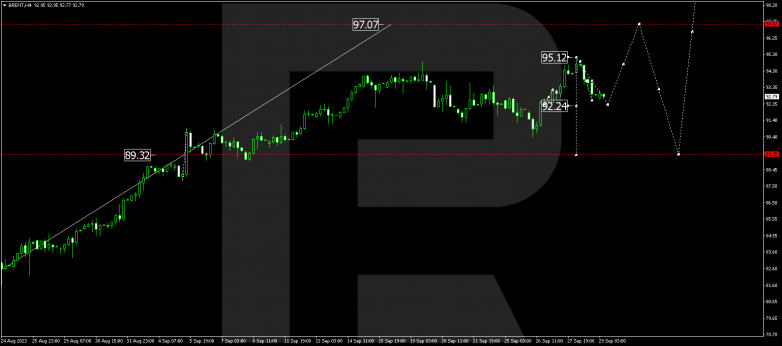

BRENT

Brent has performed a movement in a wave of growth to 95.12. Today the market is developing a correction to 92.24. After the price reaches this level, a link of growth to 93.73 is not excluded. This way the market will set the boundaries of a new range. With an escape from the range downwards, the correction could continue to 89.35. An escape upwards might open the potential for a further rise by the trend to 97.07. This is a local target.

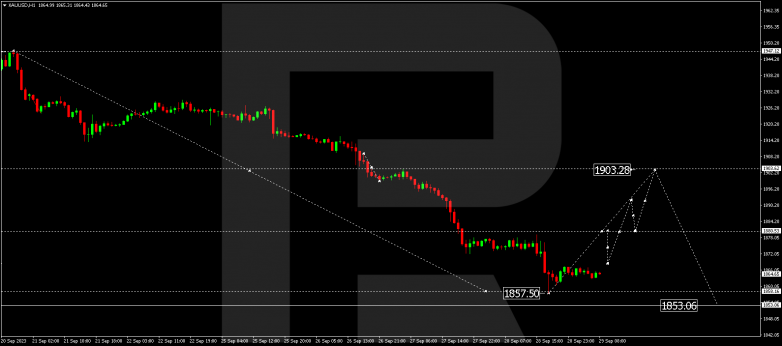

XAUUSD, “Gold vs US Dollar”

Gold has completed a wave of decline to 1857.50. Today the market is forming a consolidation range above this level. With an escape downwards, the potential for a decline to 1853.05 might open. With an escape upwards, a correction to 1880.80 is not excluded (with a test from below). Next, a decline to 1853.05 could follow.

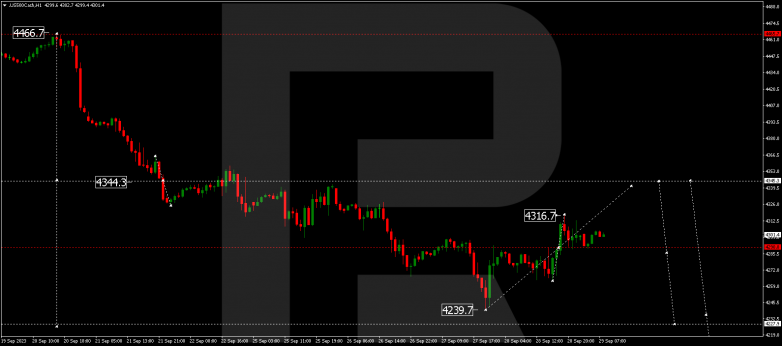

S&P 500

The stock index has completed a rise to 4290.0. Today the market is consolidating around this level. With an escape from the range upwards, the correction might continue to 4345.3. Next, a wave of decline to 4228.0 might begin.