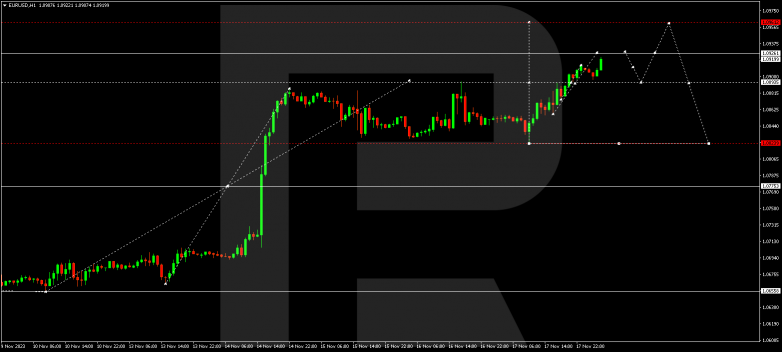

EURUSD, “Euro vs US Dollar”

EURUSD has broken the upper boundary of the consolidation range, offering the market an extension of the wave to 1.0928. Next, a link of decline to 1.0893 is not excluded, followed by a rise to 1.0960. After the price reaches this level, a decline wave to 1.0823 could start.

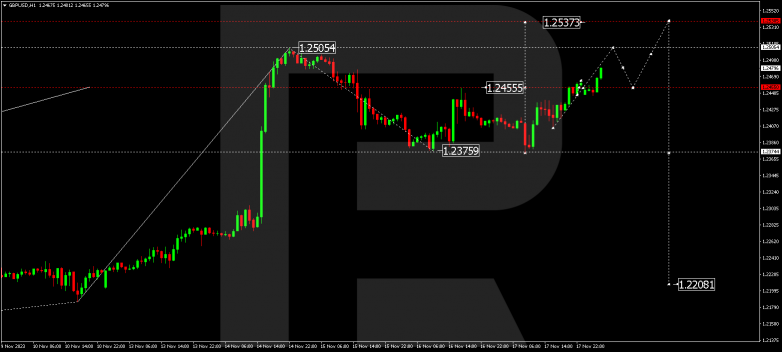

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has broken the upper boundary of the consolidation range, offering the market a link of growth to 1.2505. Next, a link of decline to 1.2455 is not excluded, followed by a rise to 1.2537. After the price hits this level, a new decline wave to 1.2374 could begin.

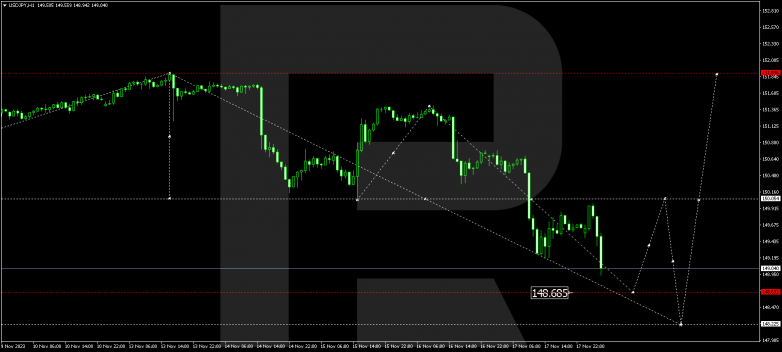

USDJPY, “US Dollar vs Japanese Yen”

USDJPY continues developing a decline wave to 148.68. After the price reaches this level, a link of growth to 150.05 is not excluded. Next, a new decline movement to 148.22 could develop.

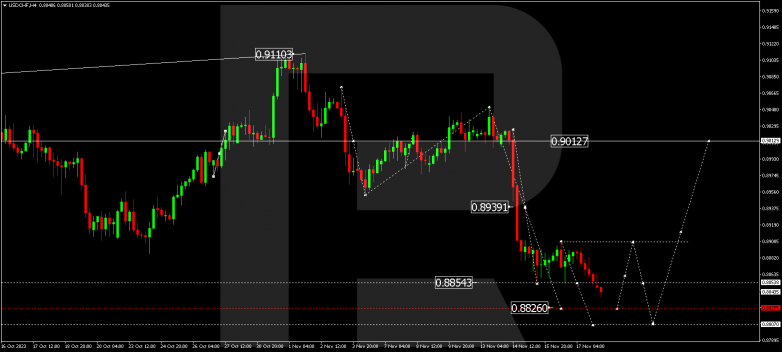

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has broken the lower boundary of the consolidation range, offering the market a decline to 0.8826. Next, a rise to 0.8853 might follow, after which a decline link to 0.8807 will not be excluded. Upon reaching this level, the price could develop a new growth wave to 0.9012.

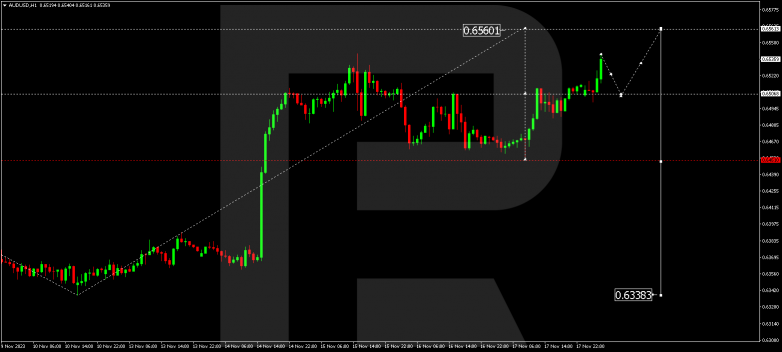

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has broken the upper boundary of the consolidation range, offering the market another growth movement to 0.6561. Upon reaching this level, the price could start a decline wave to 0.6450.

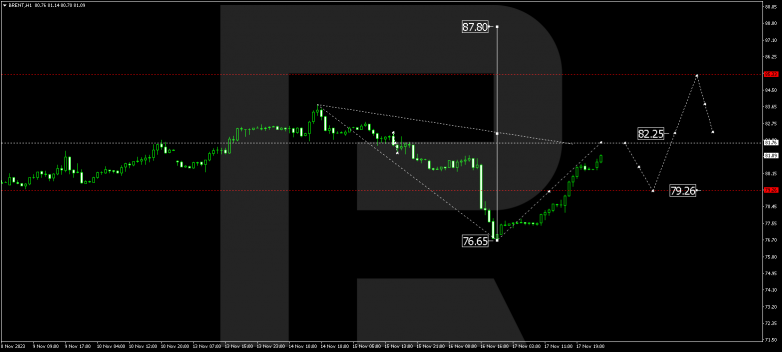

BRENT

Brent continues developing a growth wave to 82.25. Upon reaching this level, the quotes might correct to 79.25. When the correction is over, a new growth wave to 85.33 might start. This is a local target.

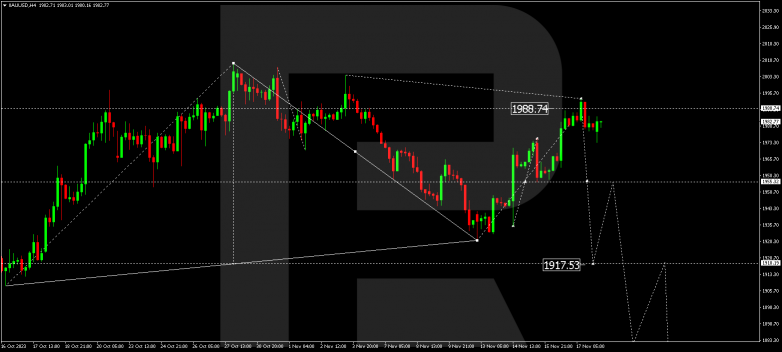

XAUUSD, “Gold vs US Dollar”

Gold has completed a growth wave to 1992.80. A decline link to 1955.33 is expected today. With a breakout of this level, the potential for a decline wave to 1917.55 could open. This is a local target.

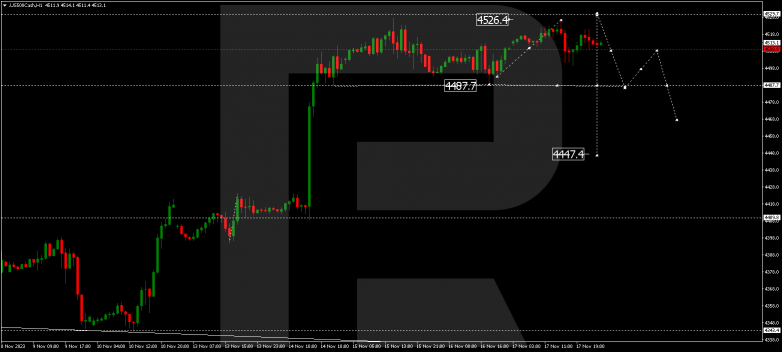

S&P 500

The stock index continues forming a consolidation range around 4510.0. The price could extend the range to 4530.0, subsequently falling to 4487.7. A breakout of this level might open the potential for a wave to 4447.0. This is a local target.