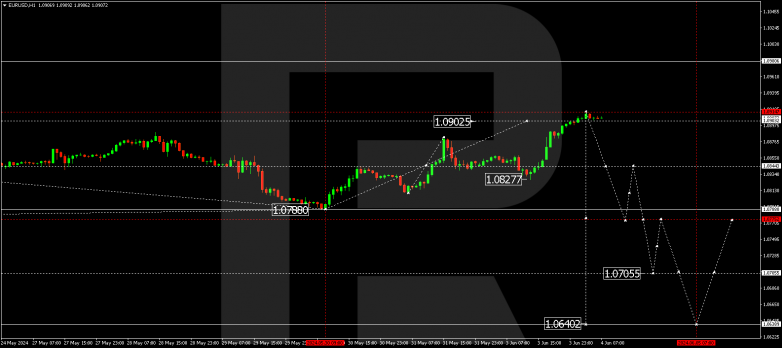

EURUSD, “Euro vs US Dollar”

The EURUSD pair has completed a growth wave, reaching 1.0915. Today, a consolidation range is forming below this level. A downward breakout and a decline towards 1.0845 are expected. A downward breakout of this level will open the potential for a wave towards 1.0776, representing the downward wave’s first target.

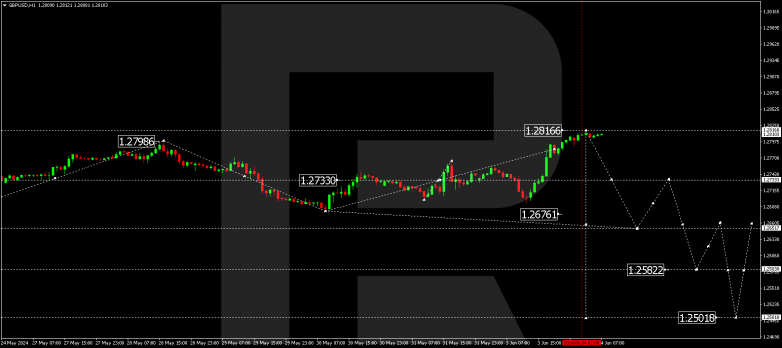

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has completed a growth wave, reaching 1.2816. A consolidation range is expected to form below this level today. A decline towards 1.2733 is expected. A breakout of this level will open the potential for a wave towards 1.2652, representing the downward wave’s first target.

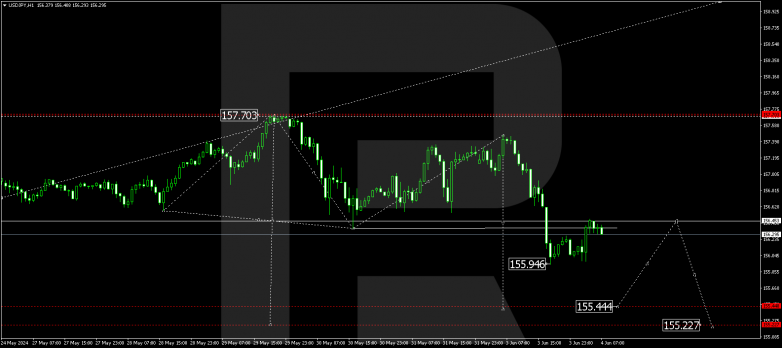

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair has broken below the 156.44 level. Today, the market is forming a consolidation range below this level. The price is expected to exit the range downwards, aiming for 155.44 and potentially moving further to 155.22. This is the downtrend’s first target.

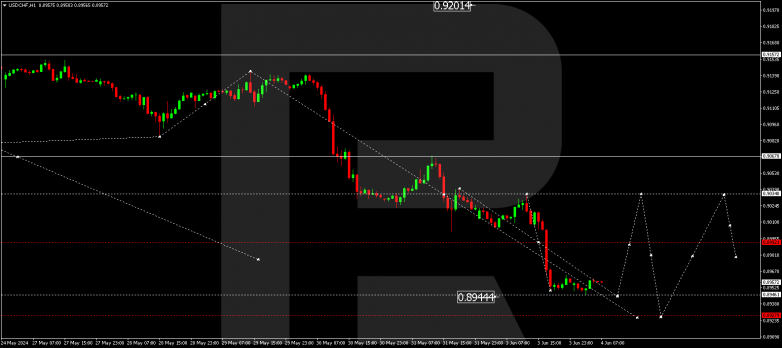

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair has completed a decline wave, reaching 0.8944. Today, a consolidation range could develop above this level. With an upward breakout, the growth wave might continue towards 0.9034 as the first target.

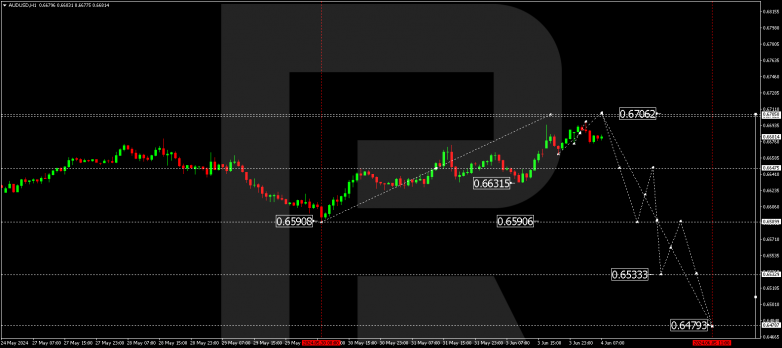

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair has completed a growth wave, reaching 0.6697. Today, a consolidation range is expected to form around this level. The price might rise towards 0.6706 and then decline towards 0.6647. A breakout of this level will open the potential for a wave towards 0.6590, representing the downtrend’s first target.

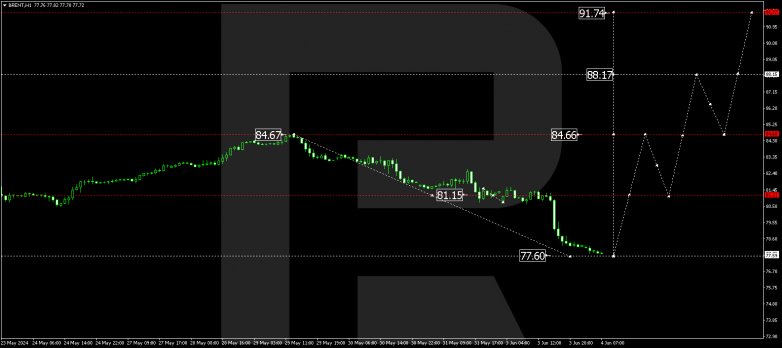

Brent

Brent has formed a consolidation range around 81.15. A downward breakout opened the potential for a decline wave towards 77.60. Once the price reaches this level, a consolidation range is expected to form above it. With an upward breakout, a growth wave could start, aiming for 81.11. If this level also breaks, the trend might continue towards 84.66, representing the uptrend’s first target.

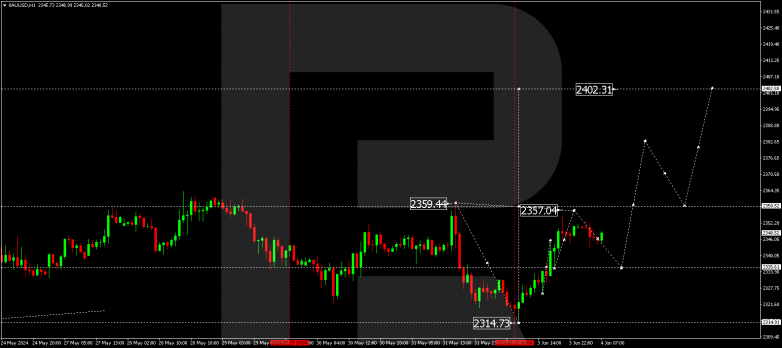

XAUUSD, “Gold vs US Dollar”

Gold is currently in a consolidation phase around 2335.60. Today, a rise towards 2357.00 is possible. Subsequently, a decline towards 2335.60 is expected (testing from above), potentially followed by a growth wave towards 2382.60, representing a local target.

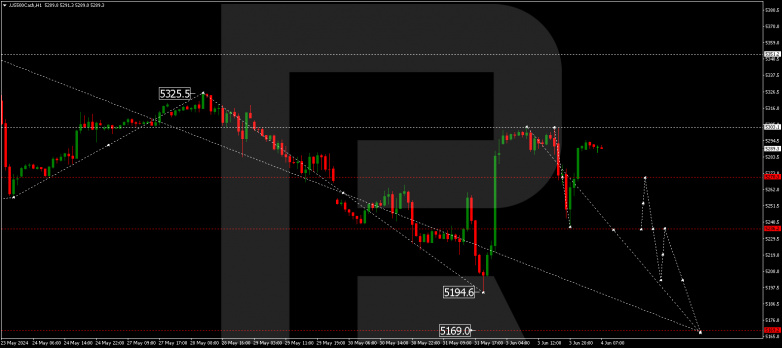

S&P 500

The stock index has completed a decline wave towards 5237.5 and corrected towards 5294.0. Today, the market is forming a narrow consolidation range below this level. With a downward breakout, the wave might continue towards 5200.0, representing the first target of the downtrend. With an upward breakout, a rise towards 5270.0 is not ruled out, followed by a decline towards 5170.0, representing the downtrend’s first target.