USDJPY starts the week with a rise. The Japanese yen comes under pressure from a strong US dollar. Find out more in our analysis dated 2 September 2024.

USDJPY forecast: key trading points

- The USDJPY pair rose to a two-week high

- Investors are monitoring statistics and awaiting US employment market reports

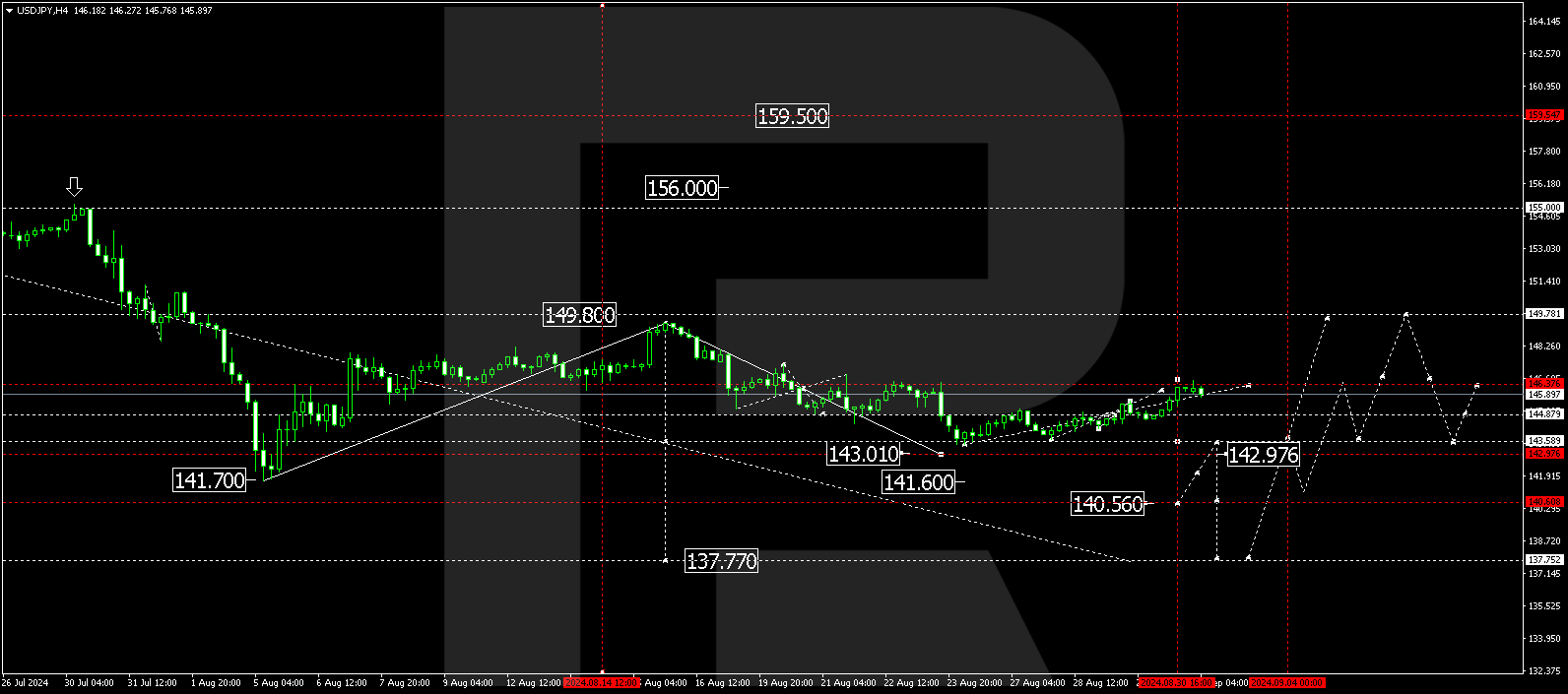

- USDJPY forecast for 2 September 2024: 143.58, 140.56 and 137.77

Fundamental analysis

The USDJPY rate rose to 146.10 at the start of the week. The strong US dollar is exerting significant pressure on yen positions after US inflation statistics forced investors to revise their expectations regarding the Federal Reserve’s interest rate trajectory.

Japanese statistics showed that the country’s companies increased capital spending by 7.4% in Q2, marking growth for the 13th consecutive quarter. Japan’s manufacturing PMI was revised upwards to 49.8 points in August from 49.5 points earlier and continues improving.

As for monetary policy, Japan’s authorities remain poised for an imminent interest rate hike, subject to the realisation of economic and price forecasts.

The market focus shifts to monthly US employment reports. The USDJPY forecast suggests local growth.

USDJPY technical analysis

The USDJPY H4 chart shows that the market has risen to 146.58 and could decline to 144.88 today, 2 September 2024. It will remain within a consolidation range between these levels. With a downward breakout of the range, the decline will continue towards 143.58. A breakout below this level may signal a continuation of the trend towards 140.56 and 137.77, with the latter remaining the main downtrend target level for the USDJPY rate. With an upward breakout, a correction could develop towards 149.78.

.png)

Summary

The USDJPY pair began the autumn season with a rise as investors favour the US dollar. However, technical indicators in today’s USDJPY forecast suggest a potential decline to the 143.58, 140.56, and 137.77 levels.