Despite rising building permits in New Zealand and declining net speculative positions on the NZD, the New Zealand dollar faces a correction. Read more in today’s NZDUSD analysis and forecast for 30 August 2024.

NZDUSD forecast: key trading points

- Building permits: previous value: -17.0%, current value: 26.2%

- Net speculative positions on NZD (CFTC): previous value: -13.8 thousand

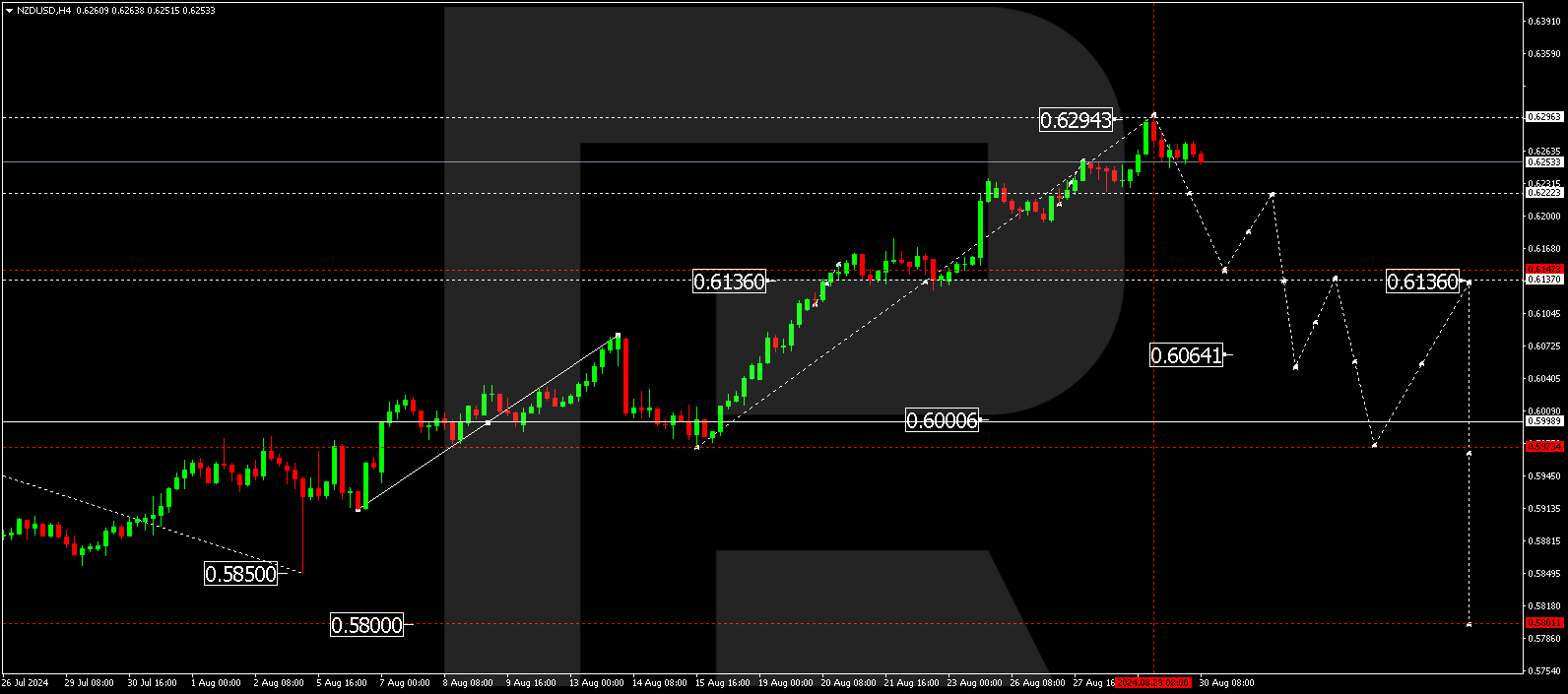

- NZDUSD forecast for 30 August 2024: targets at 0.6160 and 0.6136

Fundamental analysis

Building Consents (m/m) represent the total number of permits issued for New Zealand residential and non-residential construction projects valued at over 5,000 USD. This metric is presented as a percentage change from the previous month and includes taxes for goods and services but is not adjusted for inflation.

Building permit data is a key indicator of confidence in New Zealand’s domestic economy and a leading indicator of construction industry activity. The latest data showed a significant 26.2% increase in permits, reversing the previous month’s 17.0% decline. This surge suggests an optimistic outlook for the NZDUSD forecast, potentially supporting further EURUSD price gains after the current correction.

The Commodity Futures Trading Commission (CFTC) weekly report provides insights into speculative positions held by non-commercial traders in US futures markets. It reflects the net difference between long and short positions on the NZD in the Chicago and New York markets.

Although net speculative positions remain negative (currently forecasted at -13.8 thousand), indicating bearish sentiment, today’s NZDUSD forecast and prediction suggest the New Zealand dollar could continue to strengthen against the US dollar in the near term.

NZDUSD technical analysis

On the H4 chart of NZDUSD, the market has formed a downward impulse towards 0.6247. On 30 August 2024, we anticipate a correction up to 0.6277, defining the boundaries of the consolidation range. If the price drops to 0.6245 and breaks below, it could signal the start of a new downward wave towards 0.6160, potentially extending further to 0.6136. A breakout below 0.6222 would confirm the beginning of a new downward trend.

.png)

Summary

Combining NZDUSD fundamental and technical analyses and the latest news, today’s NZDUSD outlook and forecast suggest a potential initiation of a downward trend targeting 0.6160 and 0.6136.