Buyers have returned to the markets with fresh capital. Last week’s most threatening trends had reversed, giving way to a recovery in demand for risk before the situation got out of control.

In the US debt markets, long-term government bond yields are falling, reaching 1.4% for UST10 compared with a peak at 1.61% at some point on Thursday. The rebound in long-term bond purchases is attributed to renewed optimism based on the $1.9 trillion relief package’s imminent approval.

However, we cannot ignore macroeconomic data from the US and Europe, which indicates a stronger than expected recovery in business sentiment, an important leading indicator for the economic cycle.

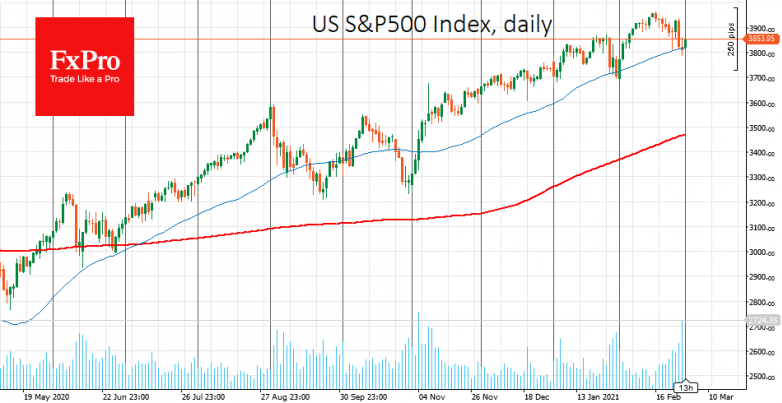

The S&P500 and DowJones30 have held their first line of defence. Investors strengthened buying on the intraday declines below the 50-day average and the round levels 3800 and 31000 on Friday, respectively.

Previously, we saw a similar slump in the indices at the end of January. There was then a bearish signal on the technical analysis, but that didn’t stop the markets from going back up and making new highs in February.

The volumes in the US market on Friday were the highest since November 4th. In a similar situation, the indices turned to growth, and a robust rally started. That’s an essential bullish signal that indicates buyers are coming back.

But the more frequently the indices mentioned above test the 50-day average and the persistence of Nasdaq100 below that level signals caution.

The gold market gave up its support on Friday. The price of the troy ounce lost more than 2.5% intraday to $1717. However, the rate was up $40 in early trading on Monday, nourishing hopes of a rebound after oversold conditions.

As in stocks, the short-term charts show methodical buying of gold on the decline, which brought the price back to the levels before massive stop-orders were triggered. However, only a move above $1770 (Friday’s intraday highs) would signal that a recovery is underway: we have seen an increase in gold selling on the rise all through February. This trend could remain in force in March as well.

The FxPro Analyst Team