Journalists often describe the current macroeconomic recovery as a K-recovery. That is, some sectors or countries (depending on the context) have a V-shaped recovery, while others continue their slide down.

The coronavirus is often thought to have a critical impact on which direction a country or sector will go down. However, in recent weeks we have seen increasing signs that the pandemic link seems an oversimplification.

It may even be the other way round: the rapid shifting of government and central bankers from crisis mode to the new reality is hurting the markets.

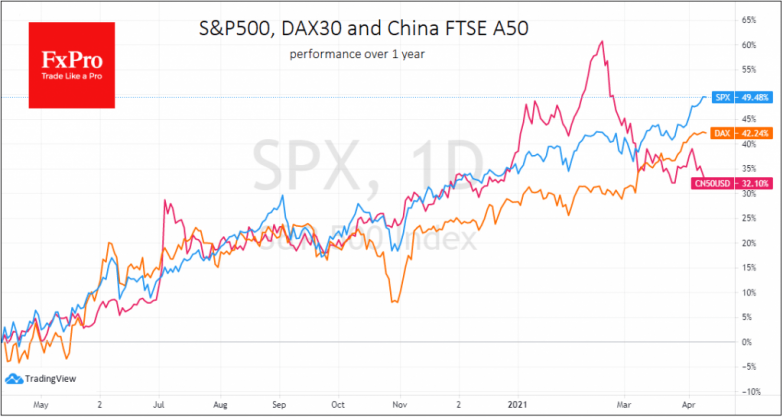

A good example is China, where the Shanghai bourse blue-chip index China A50 has been trading near 4-month lows since the end of March. In contrast, while suffering from the third wave of the coronavirus and related restrictions, Germany has the DAX near all-time highs.

Britain has made strides in vaccination and is steadily approaching the lifting of restrictions. However, its FTSE100 is far from its highs.

In terms of coronavirus cases and deaths, the US leads by a wide margin, while its markets were almost the first to hit all-time highs and have continued to do so in recent weeks.

The US & EU markets have been primarily driven by policy softness, while China is the first to turn to tighten them. Perhaps this should also be seen as a warning sign for developed markets. For example, Germany and the USA, which will have to deal with the pandemic’s economic consequences sooner rather than later, will have to simultaneously contain their real estate and asset bubbles and look for ways to fill their budgets.

Fed chief Powell said the other day that the US economy is at an ‘inflection point’, suggesting accelerated and self-sustaining economic growth.

Will we see an inflection point in the markets, only with a minus sign? Isn’t the economy’s coronavirus weakness the key to rallying markets, secured by aggressive stimulus? Wouldn’t this positive inflection spur a correction in markets to historical averages of P/E and other relative measures from their current very stretched valuations?

We may get answers to these questions in the coming weeks when we see how the market reacts to company reports and demand in the debt and currency markets.

The FxPro Analyst Team