EURUSD, “Euro vs US Dollar”

EURUSD is trading at 1.1708; the instrument is moving below Ichimoku Cloud, thus indicating a descending tendency. The markets could indicate that the price may test the cloud’s downside border at 1.1755 and then resume moving downwards to reach 1.1575. Another signal in favor of a further downtrend will be a rebound from the descending channel’s upside border. However, the bearish scenario may no longer be valid if the price breaks the cloud’s upside border and fixes above 1.1815. In this case, the pair may continue growing towards 1.1905.

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is trading at 109.86; the instrument is moving above Ichimoku Cloud, thus indicating an ascending tendency. The markets could indicate that the price may test the cloud’s downside border at 109.75 and then resume moving upwards to reach 110.60. Another signal in favor of a further uptrend will be a breakout of the descending channel’s upside border, which will complete the Double Bottom reversal pattern. However, the bullish scenario may no longer be valid if the price breaks the cloud’s downside border and fixes below 109.30. In this case, the pair may continue falling towards 108.40.

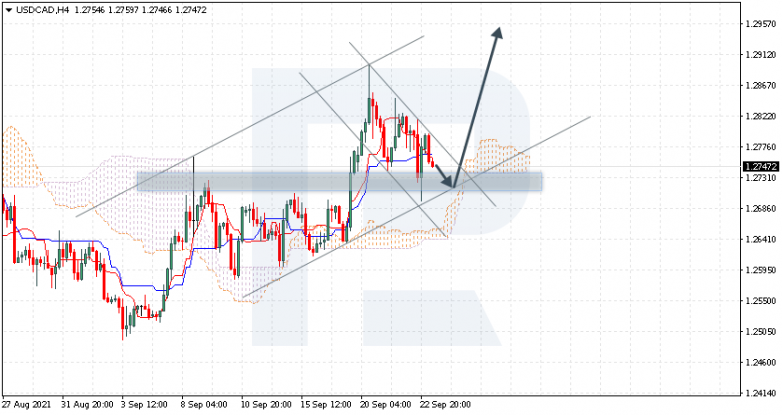

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD is trading at 1.2747; the instrument is moving above Ichimoku Cloud, thus indicating an ascending tendency. The markets could indicate that the price may test the cloud’s upside border at 1.2695 and then resume moving upwards to reach 1.2955. Another signal in favor of a further uptrend will be a rebound from the rising channel’s downside border. However, the bullish scenario may no longer be valid if the price breaks the cloud’s downside border and fixes below 1.2605. In this case, the pair may continue falling towards 1.2510. To confirm further growth, the asset must break the descending channel’s upside border and fix above 1.2795.