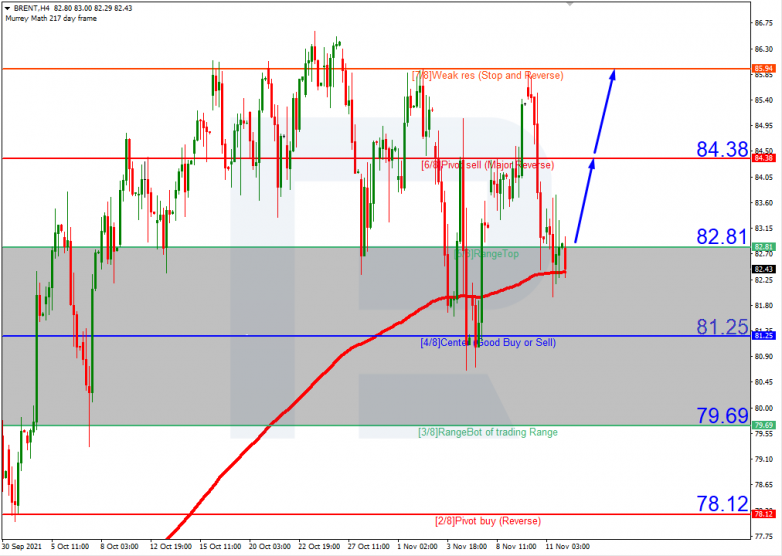

BRENT

On H4, the quotations are trading above the 200-days Moving Average, which indicates an uptrend. Currently, we expect a test of 5/8, a breakaway through it, and growth to the resistance level of 7/8. The scenario can be canceled by a breakaway of 4/8 downwards. This can lead to a trend reversal and falling to the support level of 3/8.

On M15, the price growth can be confirmed by a breakaway of the upper line of VoltyChannel.

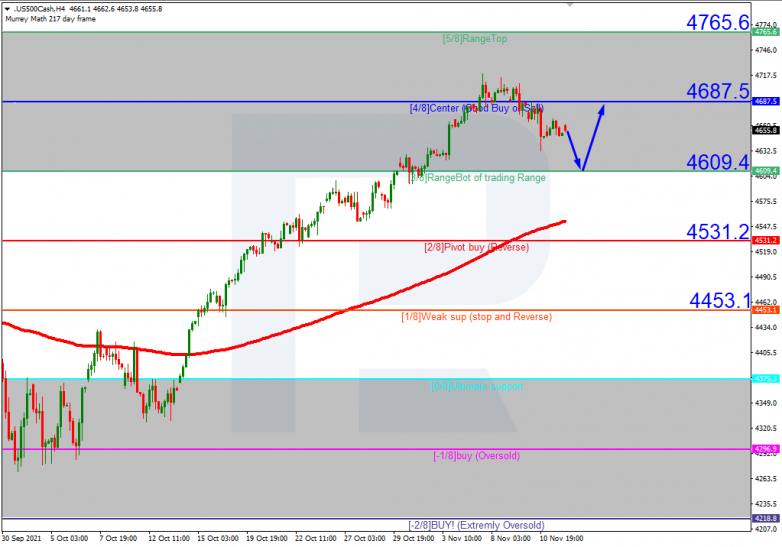

S&P 500

On H4, the quotations are trading above the 200-days Moving Average, which indicates an uptrend. However, there is currently a correction on the chart that can lead to falling to the support level of 3/8. Hence, we expect a test of 3/8, a bounce off it, and growth to the resistance level of 4/8. This scenario can be canceled by a breakaway of 3/8 downwards. In this case, the quotations will go on falling and can reach the support level of 2/8.

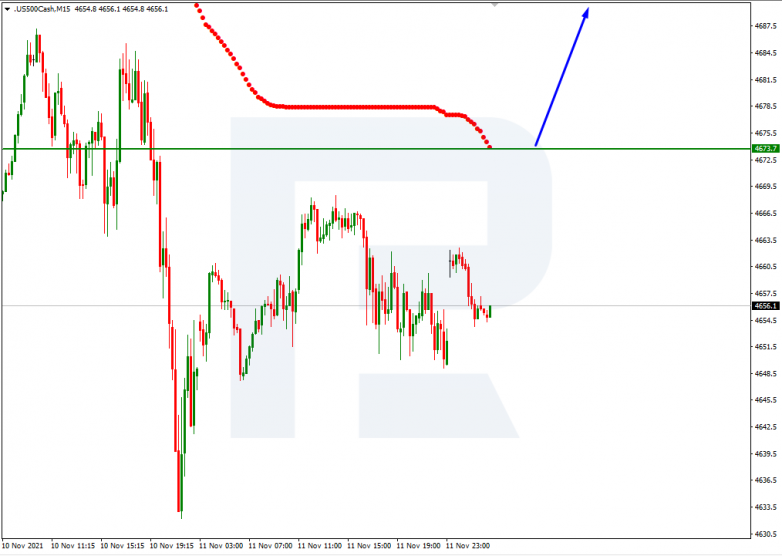

On M15, a bounce off the upper border of VoltyChannel will make growth to 4/8n on H4 more probable.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.