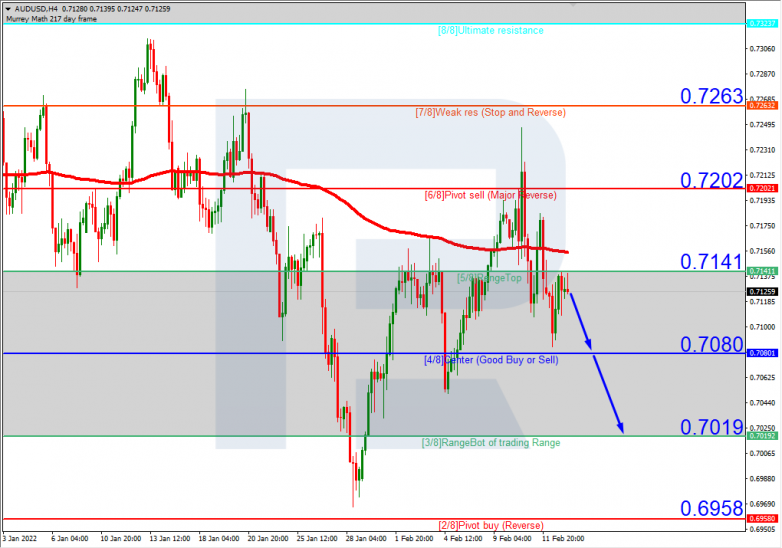

As we can see in the H4 chart, AUDUSD is trading below the 200-day Moving Average, thus indicating a possible descending tendency. In this case, the price is expected to rebound from 5/8 and then resume falling to reach the support at 3/8. However, this scenario may no longer be valid if the price breaks the resistance at 5/8 to the upside. After that, the instrument may reverse and grow towards the next resistance at 6/8.

In the M15 chart, the pair may break the downside line of the VoltyChannel indicator and, as a result, continue trading downwards.

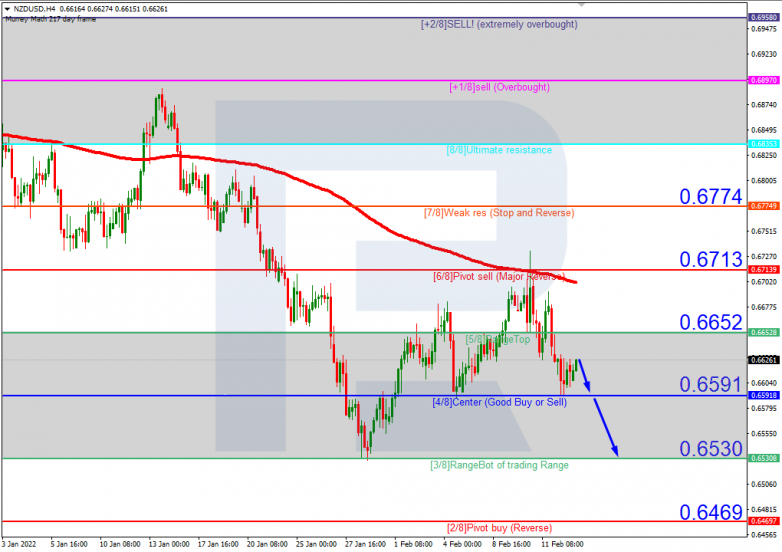

NZDUSD, “New Zealand Dollar vs US Dollar”

In the H4 chart of NZDUSD, the situation is similar. The asset is trading below the 200-day Moving Average. In this case, the price is expected to test 4/8, break it, and continue falling to reach the support at 3/8. However, this scenario may no longer be valid if the price breaks the resistance at 5/8 to the upside. After that, the instrument may reverse and grow towards 6/8.

As we can see in the M15 chart, the pair has broken the downside line of the VoltyChannel indicator and, as a result, may continue its decline.