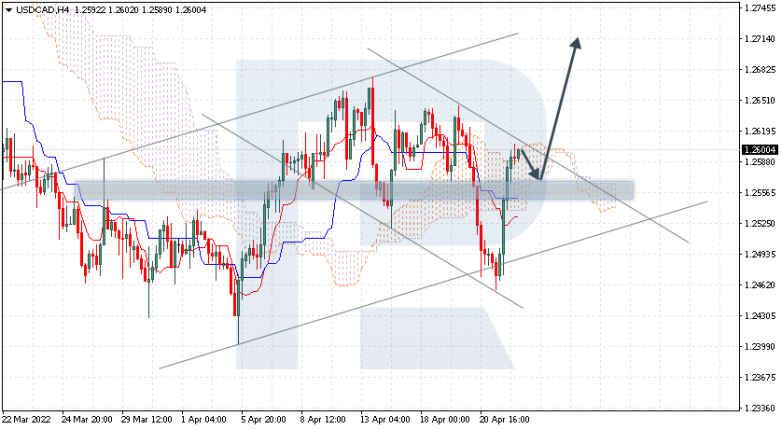

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD is testing the descending channel’s upside border. After plunging earlier, the asset quickly recovered due to significant pressure from bulls. If they fix the price above 1.2670, the asset may continue growing towards the key resistance at 1.2900, which they had been trying to break for much of the past year. The instrument is currently moving above Ichimoku Cloud, thus indicating an ascending tendency. The markets could indicate that the price may test the cloud’s downside border at 1.2570 and then resume moving upwards to reach 1.2715. Another signal in favour of a further uptrend will be a rebound from the support level. However, the bullish scenario may no longer be valid if the price breaks the cloud’s downside border and fixes below 1.2525. In this case, the pair may continue falling towards 1.2420. To confirm a further uptrend, the price must break the descending channel’s upside border and fix above 1.2625.

XAUUSD, “Gold vs US Dollar”

XAUUSD is rebounding from the downside border of a “5-0” pattern. As a rule, after rebounding from the downside border, the asset grows to update the local high, that’s why the upside target may be at 2000.00 unless the price breaks the pattern’s downside border at 1930.00. The instrument is currently moving inside Ichimoku Cloud, thus indicating a sideways tendency. The markets could indicate that the price may test the cloud’s downside border at 1950.00 and then resume moving upwards to reach 2015.00. Another signal in favour of a further uptrend will be a rebound from the descending channel’s upside border. However, the bullish scenario may no longer be valid if the price breaks the cloud’s downside border and fixes below 1935.00. In this case, the pair may continue falling towards 1890.00. The daily chart also shows a potential for the formation of a Double Bottom reversal pattern with an upside target at 1980.00. However, for this to happen, bulls have to fix the price above 1960.00.

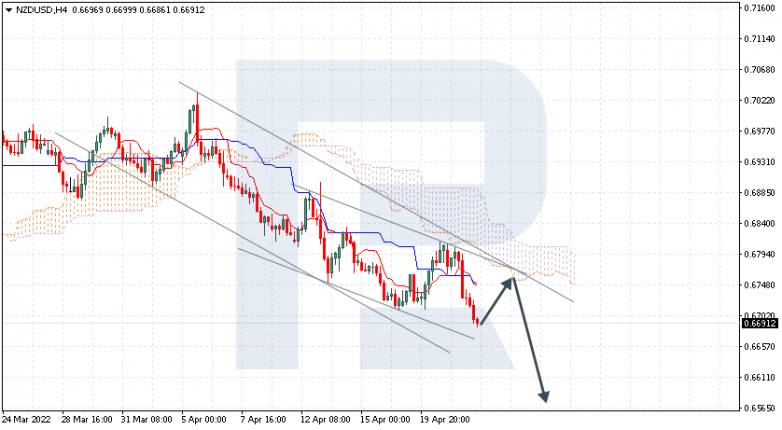

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD is falling within the descending channel. The instrument is currently moving below Ichimoku Cloud, thus indicating a descending tendency. The markets could indicate that the price may test the cloud’s downside border at 0.6750 and then resume moving downwards to reach 0.6565. Another signal in favour of a further downtrend will be a rebound from the descending channel’s upside border. However, the bearish scenario may no longer be valid if the price breaks the cloud’s upside border and fixes above 0.6840. In this case, the pair may continue growing towards 0.6935.