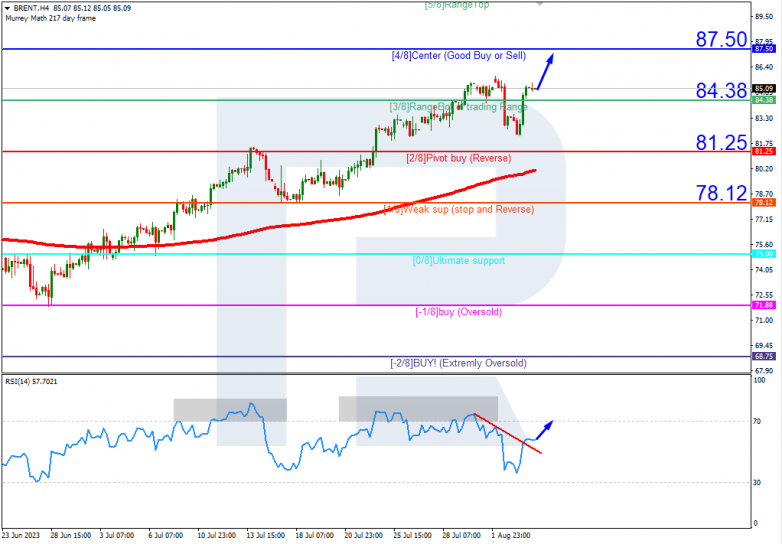

Brent quotes are hovering above the 200-day Moving Average on H4, indicating a prevailing uptrend. The RSI has broken the resistance line. As a result, in this situation, the price is expected to grow further to the nearest resistance at 4/8 (87.50). The scenario can be cancelled by a downward breakout of the support at 3/8 (84.38). In this case, the Brent quotes could return to 2/8 (81.25).

On M15, the upper line of the VoltyChannel has been broken, which increases the probability of a further price rise.

S&P 500

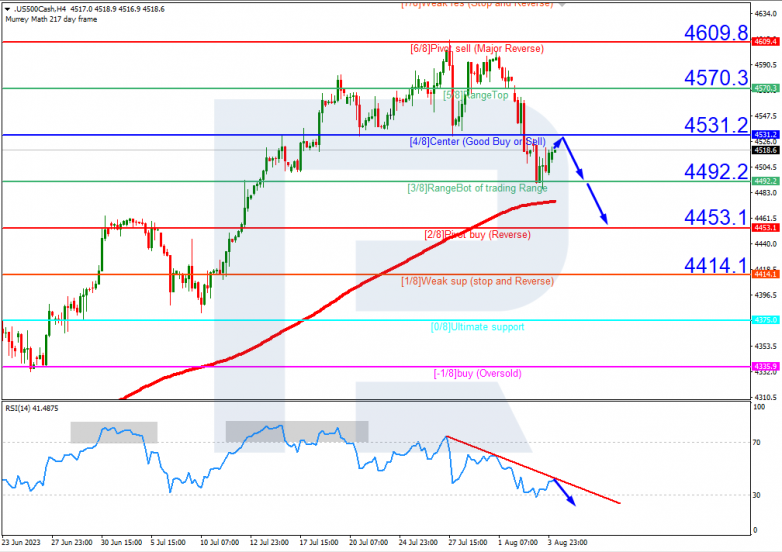

S&P 500 quotes are above the 200-day Moving Average on H4, which indicates a prevailing uptrend. The RSI is nearing the resistance line. Currently, the price is expected to test the 4/8 (4531.2) level, rebound from it and decline to the support at 2/8 (4453.1). The scenario can be cancelled by a breakout of the resistance at 4/8 (4531.2). In this case, the S&P 500 index could continue to rise and reach 5/8 (4570.3).

On M15, after the price tests the 4/8 (4531.2) level, an additional signal for the price to fall could be a breakout of the lower boundary of the VoltyChannel.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.