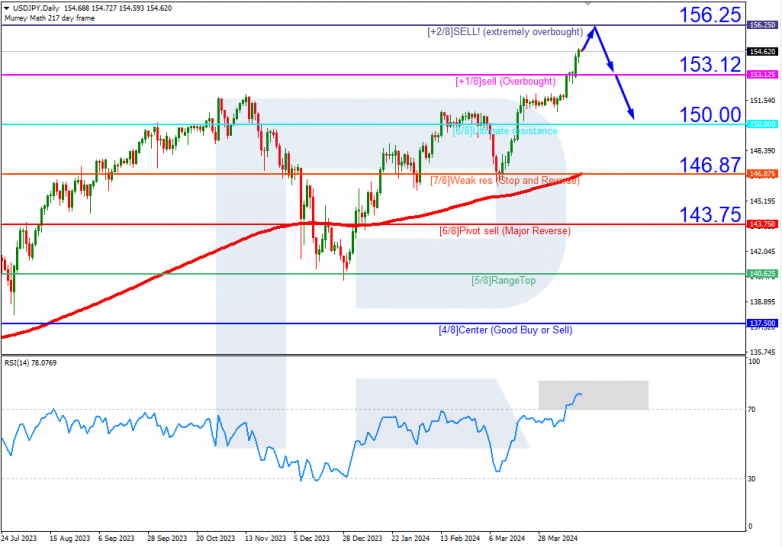

USDJPY quotes and the RSI are in the overbought areas on D1. In this situation, the price is expected to test the 2/8 (156.25) level, rebound from it, and decline to the support at 0/8 (150.00). The scenario could be cancelled by rising above the 2/8 (156.25) level, which might reshuffle the Murrey indication, setting new price movement targets.

On M15, following a rebound from the 2/8 (156.25) level on D1, the price decline could be additionally supported by a breakout of the lower boundary of the VoltyChannel.

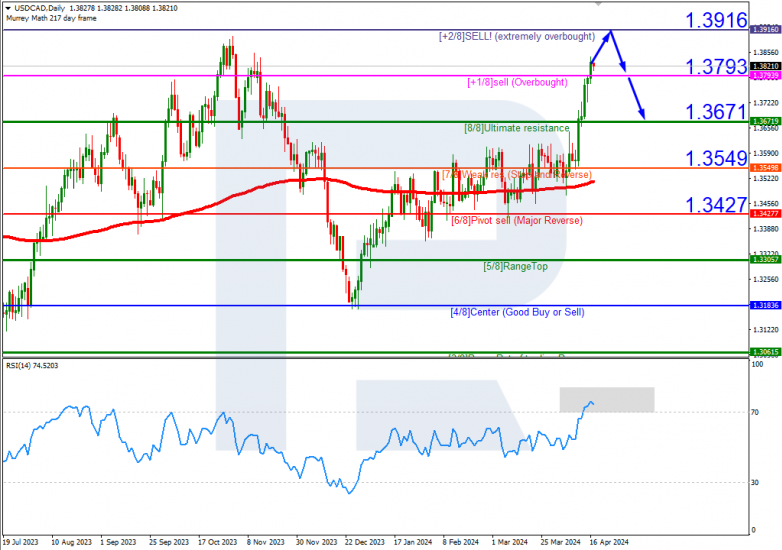

USDCAD, “US Dollar vs Canadian Dollar”

The USDCAD chart shows a similar situation, with the pair’s quotes and the RSI in the overbought areas on D1. In this situation, the quotes are expected to test the 2/8 (1.3916) level, rebound from it, and drop to the support at 0/8 (1.3671). The scenario could be cancelled by surpassing the 2/8 (1.3916) level, which might reshuffle the Murrey indication, setting new price movement targets.

On M15, following a rebound from the 2/8 (1.3916) level on D1, the price decline could be additionally supported by a breakout of the lower boundary of the VoltyChannel.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.