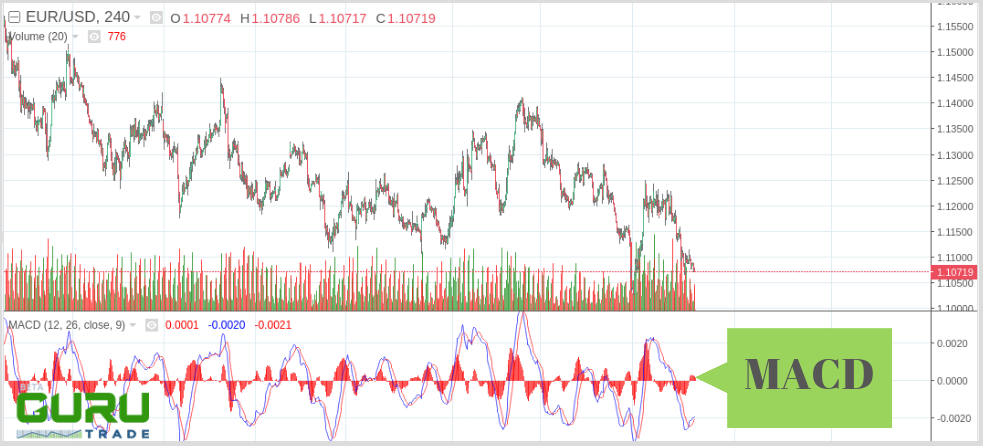

The Moving Average Convergence/Divergence (MACD) indicator is a technical indicator created by Gerald Appel and used in technical analysis to assess and predict price fluctuations in stock and currency exchanges.

The key rule of trading with MACD is build on the intersection of the indicator with its signal line: when the Moving Average Convergence/Divergence drops below the signal line, you have to sell, and when it rises above the signal line - to buy. The MACD zero line up/down crossovers are also used as buy/sell indicators.

Moving Average Convergence/Divergence is also a valuable indicator of overbought/oversold. When the short moving average rises significantly higher the long one, it indicates that the price of the trading instrument is might be too high and soon will return to a more realistic level.

When you notice a discrepancy among the MACD and the rate, it indicates that the trend might end soon. Bull's divergence takes place when the MACD reaches new peaks and the price fails to hit them. A bearish divergence takes place when the indicator hits new lows and the rate does not.

Both types of divergence are most noteworthy if they are formed in the overbought/oversold areas. The longer time frame is, the less false signals will be framed. Weekly and daily charts give good results, to a lesser extent - hourly charts. Relative price volatility is higher on small timescales.

If you always "Buy" when a shorter moving period crosses a longer moving period from bottom to top and "Sell" when it crosses from top to bottom, the results may be poor. After crossing the lower moving average of the smaller period of the longer moving average period from bottom to top, the rate often rolls back in the opposite direction, leading to a loss in the position opened on this intersection.

A common approach to eliminating the drawbacks of any indicator is to add additional indicators: ADX, RSI, Stochastic and others. In this case, we can say that the system of two, three or four indicators become more difficult for correct reading of all signals.

However, first of all, as testing shows, such a system does not necessarily become effective. Secondly, it is important for a trader, who starts to work in the market for buying and selling shares or currency pairs, to have a system as simple as possible because it is much more difficult to handle several indicators at once.